SAHI JAWAB FOR INSURANCE

Relevance: GS 3 – Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment

Why in the news?

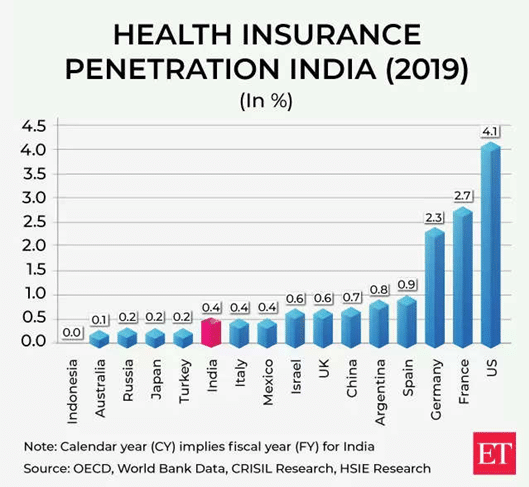

- India’s insurance industry is undergoing a major transformation.

- Growth of health insurance is the primary driver of this change.

- The Insurance Regulatory and Development Authority of India (IRDAI) has transitioned from rule-based to principle-based regulations.

- The aim is to achieve universal insurance coverage by 2047.

Insurance market in India

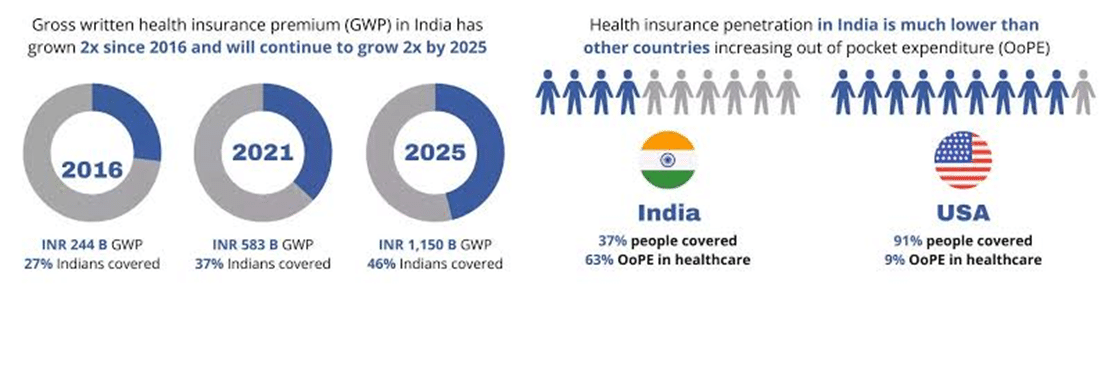

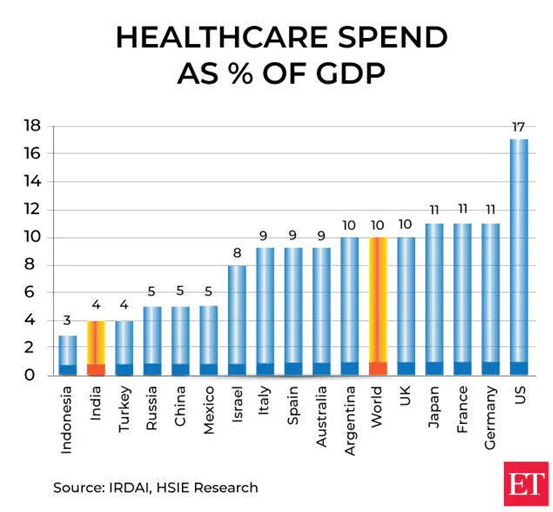

The market has reached $10 billion in gross written premium (GWP), making it the fastest-growing segment.

Factors driving this growth include:

- Population increase.

- High out-of-pocket healthcare costs.

- Increased awareness post-Covid.

- Medical inflation.

- Introduction of stand-alone health insurers (SAHIs).

Health Insurance Premium Trends

- Health insurance premiums tend to increase over time due to ageing policyholders’ health risks.

- In contrast, other insurance sectors see premiums decline due to asset depreciation.

- Health insurance holds a 38% market share in general insurance.

Stand-Alone Health Insurers (SAHIs) Performance

Well-run SAHIs have gained a significant share in the individual health segment. SAHIs have shown:

- 25%-plus growth rates.

- 61% superior loss ratios.

- Extensive agency/hospital networks and strong partnerships. SAHIs excel due to their product focus.

Distribution Channels and Profitability

- Agencies dominate individual health insurance distribution.

- Direct-to-consumer channels have a lower than 95% combined operating ratios.

- SAHIs have penetrated SMEs’ group health products more profitably than traditional group products.

Financial Performance and Sustainability

- Leading SAHIs have recorded underwriting profits recently.

- Factors contributing to their sustainability include:

- Over 80% persistency rates.

- Optimal risk underwriting/pricing interventions, including price hikes.

- Operating leverage driven by scale.

- This leads to a sustainable 25%-plus return on equity at scale.

Innovation and Technology in Health Insurance

- Innovation and tech are driving growth in the health insurance sector.

- Insurers leverage tech for:

- Product innovation.

- Wellness incentives.

- Micro-insurance to deepen penetration.

- This reflects broader healthcare industry trends toward consumerization and advanced tech solutions.

Investments in Advanced Analytics and Data Utilization

- Substantial investments have been made in:

- Predictive analytics.

- Risk mitigation.

- Fraud detection.

- Harnessing data availability.

- Convenience and personalization are driving forces.

- Advanced data and analytics reliance involves efforts from:

- Distribution partners.

Data Sharing and Customisation

- Customers are increasingly comfortable sharing data.

- Insurers are exploring various data sources for:

- Potential incorporation of social footprint mapping to:

- Enhance customer experience.

- Expand coverage to underserved areas and demographics.

IRDAI’s Initiatives and Policy Measures

- IRDAI has catalyzed the transformation with strong policy measures over the last 18 months.

- Key initiatives include:

- Bima Sugam (digital platform).

- Bima Vistaar (comprehensive product).

- Bima Vahaks (last-mile communication network).

- Efforts to improve customer experience and reduce fraud involve:

- Simplifying policy wordings.

- Expense of management.

- Use and file.

- Expanding cashless services.

Introduction of Composite Licences and Sector Growth

- Likely introduction of composite licences will allow insurers to offer integrated life, general, and health insurance solutions.

- This may increase competitive intensity but is expected to catalyse sector growth through:

- New agents.

- Improved agent productivity.

- Expansion into nascent distribution segments.

Financial and Regulatory Catalysts

- Introduction of Ind AS and risk-based solvency in the next few years are long-term catalysts.

- These measures can free up capital and increase ROEs, though they may present short-term volatility.

Investor Interest and Key Deals

- Investor interest remains robust due to:

- Low retail penetration rate of 4% (basis number of lives covered).

- Higher customer engagement metrics.

- High lifetime customer value.

- Attractive returns on equity.

- Key deals include:

- Bupa’s $325 mn-plus investment to increase their shareholding in Niva Bupa.

- ADIA’s investment in Aditya Birla Health Insurance.

M&A Opportunities

- Presence of only five SAHIs adds a meaningful scarcity premium.

- M&A opportunities in the sector include:

- Capital recycling by financial sponsors.

- Greenfield ventures by new entrants or carving out the health insurance business by existing general insurance players.

- Composite licence-driven outcomes for existing players, integrating life and general insurance interests.

Projected Growth and Market Evolution

- The sector is projected to grow at around 20% CAGR over the next five years.

- Regulatory measures have catalysed the sector’s growth, providing a solid platform for future potential.

SAHI Players and Market Expansion

- Best-in-class SAHI players, with strong starting positions and focus on:

- Product innovation.

- Healthcare expertise.

- These players are expected to expand their market share.

- Health insurance players may look towards backward and forward integration, offering value-added healthcare services for a seamless customer experience.

Continued Attraction for Financial Sponsors and Strategic Capital

- With robust growth and favourable financial metrics, the sector will continue to attract financial sponsors and strategic capital.

Source:

https://m.economictimes.com/opinion/et-commentary/sahi-jawab-for-insurance/articleshow/108771203.cms

Mains Question

Discuss the transformative trends and growth prospects in India’s health insurance sector, focusing on regulatory reforms and the role of technology and innovation. (Word limit: 250 words)