RISING STATE BORROWINGS AND ASSOCIATED RISKS

Why in the News?

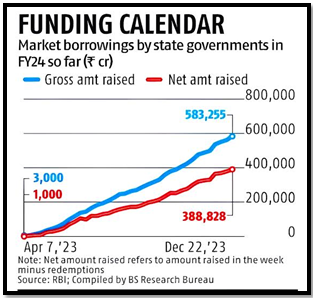

- State governments in India are borrowing more, raising concerns about rollover risks. This is due to the significant increase in market borrowings to fund the gap between revenues and expenditures.

- The 16th Finance Commission’s recommendations will guide state fiscal deficits from 2026-2027 to 2030-2031, with an assumption that the state fiscal deficit will be pegged at 3% of GDP over the medium term.

Source: BS

Data of Market Borrowings

- Market borrowings by states surged to ₹101 trillion in 2023-24 from ₹4.8 trillion in 2018-19.

- State-government securities (SGS) rose to ₹56.5 trillion by March 2024, equivalent to 55% of Government of India securities.

- Uttar Pradesh, Tamil Nadu, Maharashtra, Karnataka, and Gujarat will lead market borrowings, ensuring high issuance in the next decade.

Managing Rollover Risks

- Rollover risk, the risk of refinancing debt, is a key concern for state borrowings.

- The weighted average maturity of SGS increased to 8.5 years by March 2024, reducing near-term rollover requirements.

- In 2023-24, Andhra Pradesh, Karnataka, and Telangana borrowed in longer tenors, while Gujarat and Chhattisgarh chose shorter tenors.

- New loans from the Centre, including GST compensation loans and 50-year interest-free loans, have influenced the borrowing landscape.

Government Borrowing

Government Securities (G-Secs)

Treasury Bills (T-Bills)

Associated Article: |