RISING DEBT STRAINS HOUSEHOLD SAVINGS

Syllabus:

GS 2:

Indian Economy and issues relating to Planning, Mobilization of Resources, Growth and Development.

Why in the News?

The recent significant drop in the household net financial savings to GDP ratio has sparked debates about the underlying causes, with experts discussing whether this is due to structural economic shifts or merely a change in savings composition.

Source:TH

Misconceptions about Household Savings

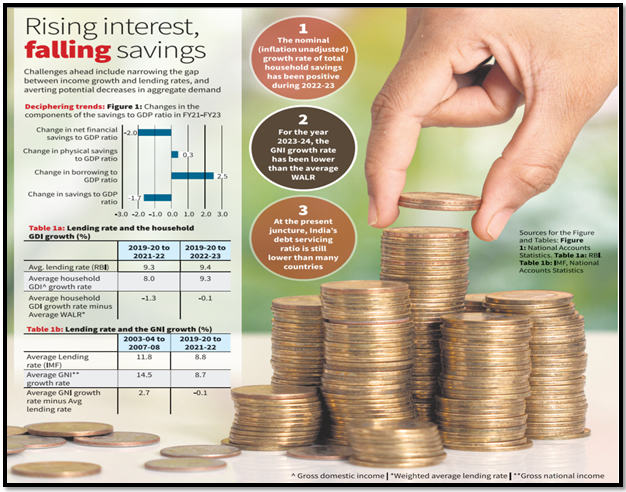

- Debate Focus: The recent debate has centered around the drastic fall in household net financial savings to GDP ratio during 2022-23, primarily due to increased borrowing.

- CEA’s Interpretation: The Chief Economic Advisor (CEA) attributed this trend to a shift in the composition of household savings, suggesting households are borrowing more to finance physical savings.

- Counter Argument: This view is inconsistent with broader economic trends, indicating structural shifts rather than a mere change in savings patterns.

- Structural Shifts: The decline in household net financial savings to GDP ratio, coupled with a smaller increase in physical savings to GDP ratio, points towards deeper economic changes.

- Economic Realities: The overall household savings to GDP ratio has fallen, indicating that higher borrowing cannot be solely explained by changes in savings composition.

| Saving to GDP Ratio

The saving to GDP ratio is a critical economic indicator that measures the proportion of a country’s gross domestic product (GDP) that is saved by households, businesses, and the government. This ratio provides insight into the saving behaviour within an economy and its ability to fund investments and growth. Here’s a detailed explanation: Definition Saving to GDP Ratio: It is the percentage of a country’s total savings in relation to its GDP. This ratio can be broken down into:

Components

Calculation Saving to GDP Ratio= (Total Savings / Gross Domestic Product)×100 |

Changes in Savings Patterns

- Savings Composition: The household savings to GDP ratio includes net financial savings, physical savings, and gold/ornaments. A mere shift would leave the overall ratio unchanged.

- Net Financial Savings: During 2022-23, the net financial savings to GDP ratio declined by 2.5 percentage points.

- Physical Savings: The physical savings to GDP ratio increased by only 0.3 percentage points.

- Increased Borrowing: Household borrowing to GDP ratio rose by 2 percentage points, more than the increase in physical savings.

- Gold Savings: The gold savings to GDP ratio remained largely unchanged, contributing to a 1.7 percentage point decline in the overall household savings to GDP ratio.

Financial Distress and Interest Burdens

- Interest Commitments: The decline in net financial savings and rise in borrowing largely reflect households’ need to finance higher interest payments amid rising interest rates.

- CEA’s Nominal Analysis: The CEA’s focus on nominal values of household savings overlooks the real issue of increasing financial distress due to higher interest payments.

- Interest Burden: Households face greater financial stress due to higher interest payment burdens and debt-income ratios in the post-COVID period.

- Structural Changes: These trends suggest significant structural shifts in the economy rather than temporary changes.

- Historical Context: Comparing past and present episodes of high household borrowing reveals distinct differences in the underlying economic conditions.

Structural Shifts in the Economy

- Debt-Income Ratio: The debt-income ratio has risen due to higher borrowing and increased interest rates, leading to greater financial burdens.

- Net Borrowing: An increase in net borrowing (difference between total borrowing and interest payments) contributes to higher household debt.

- Exogenous Factors: Factors like rising interest rates and lower nominal income growth rates exacerbate the debt-income ratio.

- Fisher Dynamics: Following Irving Fisher’s concept, the rise in debt-income ratio reflects changes in interest rates and nominal income growth.

- Pre-COVID Trends: The pre-COVID slowdown and post-COVID period have seen a significant rise in the debt-income ratio due to lower nominal income growth.

Macroeconomic Challenges

- Debt Servicing Ratio: While India’s debt servicing ratio is still lower than many countries, the rise in debt-income ratio poses unique challenges.

- Interest Rate vs. Income Growth: Reducing the gap between interest rates and income growth is crucial to prevent rapid increases in the debt-income ratio.

- Aggregate Demand: High interest payments and debt commitments can lead to a downward adjustment of aggregate demand if households reduce consumption to manage debt.

- Consumption Decline: The sharp decline in the consumption to GDP ratio in 2023-24 points to reduced household spending due to financial pressures.

- Policy Response: There is a need for macroeconomic policies that support household income growth to reduce financial stress and stabilize the macroeconomy.

Way Forward:

- Enhance Household Income: Implement policies to boost household income growth, such as tax incentives, wage subsidies, and support for small businesses, to alleviate financial stress.

- Monetary Policy Adjustments: The central bank should consider moderating interest rates to reduce the debt servicing burden on households, fostering a balance between borrowing costs and income growth.

- Encourage Savings: Promote financial literacy programs to encourage prudent savings and investment habits among households, ensuring better financial management and resilience.

- Support Employment: Strengthen job creation initiatives through infrastructure projects and industrial policies to increase household earnings and stability.

- Affordable Credit: Enhance access to affordable credit for households by expanding financial inclusion programs and supporting microfinance institutions.

- Inflation Control: Implement measures to control inflation, preserving household purchasing power and preventing erosion of real income.

- Debt Management Programs: Introduce debt management and relief programs to help households restructure or consolidate debts, reducing their financial burden.

- Monitor Economic Indicators: Establish a robust framework for monitoring key economic indicators related to household debt and savings, enabling timely policy interventions to address emerging financial stress.

Conclusion

Addressing the decline in household net financial savings requires comprehensive macroeconomic policies that enhance household income growth, reduce financial burdens, and stabilize the economy. Proactive measures can mitigate the impact of rising debt and ensure sustainable economic development.

Source:The Hindu

Mains Practice Question:

“Analyze the causes and implications of the decline in household net financial savings to GDP ratio in India. Discuss the measures that can be taken to address this issue and ensure macroeconomic stability.”

Associated Article: