Rethink the emerging dynamics of India’s fiscal federalism.

Relevance

- GS Paper 2 Polity- Fiscal Federalism.

- GS Paper 3 Economy- Inclusive growth.

- Tags: #upsc #fiscalfederalism #Indianconstitution #Inclusivegrowth #federalism.

Why in the news?

- A ‘holding together federation’ with a built-in unitary bias, the Indian Constitution was the contextual product of centrifugal forces and fissiparous tendencies in the run-up to Independence.

Fiscal Federalism

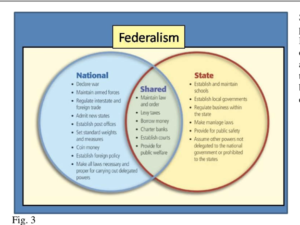

- Fiscal federalism refers to the financial relations between the Union Government and the state governments.

- It focuses on how expenditure and revenue are allocated across different vertical layers of the government administration.

About

- It has journeyed over 73 years with remarkable resilience. Even so, the emerging dynamics of India’s fiscal federalism needs some rethinking.

- The paradigm shift from a planned economy to a market-mediated economic system, the transformation of a two-tier federation into a multi-tier fiscal system following the 73rd and 74th Constitutional Amendments, the abolition of the Planning Commission and its replacement with NITI Aayog.

- The passing of the Fiscal Responsibility and Budget Management (FRBM) Act, with all the States forced to fall in line, the Goods and Services (GST) Act with the GST Council holding the controlling lever.

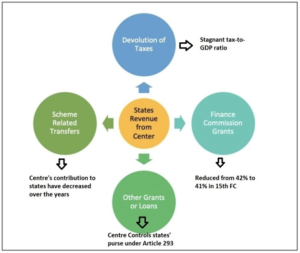

- The extensive use of Cess and surcharges which affect the size of the divisible pool and so on have altered the fiscal landscape with varying consequences on India’s federalism.

Issues

- India’s intergovernmental transfer system should be decidedly more equity-oriented. Although the natural proclivity of any market-mediated growth process is to work in favor of the propertied class, the actual experience in India has been astounding.

- Indeed, equity should be the overarching concern of the 16th Finance Commission and that HDI could be considered as a strong candidate in the horizontal distribution of tax devolution.

- There is a case for revisiting Article 246 and the Seventh Schedule for a denovo division of powers, functions and responsibilities for a variety of reasons.

- India is no longer the one-party governance of post-Independence times. It has become a truly multi-party system. The nature of polity, society, technology, demographic structure and the development paradigm itself have significantly changed.

- Under the changing dispensation, several pieces of central legislation such as the Mahatma Gandhi National Rural Employment Guarantee Act 2005, the Right of Children to Free and Compulsory Education Act 2009, the National Food Security Act 2013 and many others impose an extra burden on the States.

- At the time of constitution-making, we never asked the pertinent question of who should do what and who should tax what. We borrowed copiously from the Government of India Act 1935 and failed to apply the subsidiarity principle, viz., that whatever could be done best at a particular level should be done at that level and not at a higher level, in the division of functions and finance.

- Although the 73rd and 74th Constitutional Amendments provided an opportunity to re-examine the issue, nothing was done.

Review off-Budget borrowing

- Off-Budget borrowings mean all borrowings not provided for in the Budget but whose repayment liabilities fall on the Budget.

- They are generally unscrutinized and unreported. That all income and expenditure transactions should fall under some Budget head or other is a universal principle.

- State public sector undertakings and special purpose vehicles raise resources from the markets, but their servicing burden often falls on the State government.

- In cases where the government is the ultimate guarantor, the burden of repaying the debt also falls on the State.

- Although the States are disciplined through Article 293(3) by the Union and through the FRBM Act, the Union often escapes such controls.

- The liberal utilization of the National Small Saving Fund (NSSF) for extra-budgetary financing of central public sector undertakings and central ministries by way of loans is not reflected in the Union fiscal deficits.

- This is because only the Consolidated Fund of India balance is considered for calculating fiscal deficit, and items in public accounts such as the NSSF are kept out. While the borrowing space of States is restricted, the Union escapes such discipline.

- There is also a huge area of special banking arrangements using public sector banks to facilitate cash and credit flow outside the budgetary appropriations to help various agencies involved in quasi-fiscal operations with the government.

- Transparency guarantees and public accountability demand that the Union, States and local governments come clean and bring all extra-budgetary transactions to the public domain.

Role and status of the third tier of government-local self-government institutions in India

- Placement of the Third Tier on the Fiscal Federal Map: The third tier of government has not been placed properly within India’s fiscal federal structure. There has been a persistent failure to adequately recognize and accommodate local self-government institutions within the broader fiscal framework.

- Lack of Uniform Financial Reporting System: There is an absence of a consistent financial reporting system that encompasses all levels of government, including local bodies. There is a need for standardized budgeting rules and the adoption of an accrual-based accounting system across all tiers of government.

- Identity of the Third Tier: While the Constitution refers to the third tier as “institutions of self-government,” there seems to be a discrepancy in how these institutions are referred to by policymakers, experts, and even entities like the Union Finance Commissions (UFCs).

- Instead of being recognized with their proper designation, they are often simply referred to as “local bodies.” This suggests a lack of respect and proper recognition of their role and significance.

- Challenges in Building Local Democratic Base: There has been a perceived failure in building a strong local democratic foundation in India, despite having a vast number of elected representatives at the local level.

- There are over 3.2 million elected representatives and 2.5 lakh rural and urban local governments. Despite this, there seems to be an unexplained “enigma” surrounding the inability to effectively empower and utilize this local democratic structure.

- Importance of Local Governments: The passage emphasizes that local self-government institutions have a critical role to play in a diverse and heterogeneous federation like India. They are seen as essential for providing basic services of consistent quality to all citizens, regardless of their place of residence.

Focus Areas for Reform

- Equity in intergovernmental transfers is a central concern. Economic growth often disproportionately benefits the affluent, leading to rising income inequality.

- Introducing factors such as the Human Development Index (HDI) in tax distribution can help create a more equitable approach.

- Ensuring clarity: The evolving landscape, including a shift to a multi-party system and changing demographics, necessitates a fresh examination of the division of powers and responsibilities among various tiers of government.

Conclusion

- As India’s fiscal federalism continues to evolve, the 16th Finance Commission should lead a comprehensive rethinking process. The shift from planned to market economies, combined with changing fiscal paradigms and diverse economic shifts, requires recalibrating India’s fiscal federalism approach.

- Ensuring equity, revisiting powers and functions allocation, strengthening the third tier, and curbing unregulated borrowing practices are essential facets that demand urgent attention. By reassessing these dynamics, India can better align its fiscal policies with the principles of inclusivity and balanced development.

- In sum, the dynamics of the emerging fiscal federalism of India entails significant rethinking especially in the context of the 16th Finance Commission.

Source: The Hindu

Main Question

How has the evolution of India’s political landscape, from a one-party governance to a multi-party system, necessitated a reevaluation of the division of powers, functions, and responsibilities among different tiers of government?