RBI’S UNIFIED LENDING INTERFACE REVOLUTIONIZES RURAL CREDIT ACCESS

Why in the news?

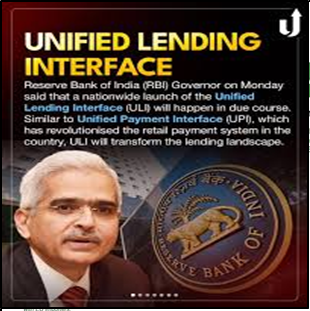

The RBI launched the Unified Lending Interface (ULI) to streamline credit access for farmers and MSMEs, enabling quicker loan approvals through seamless data integration and reduced documentation.

source:medium

Introduction to Unified Lending Interface (ULI):

- The Reserve Bank of India (RBI) announced the launch of the Unified Lending Interface (ULI) as part of its digital public infrastructure strategy.

- Developed by the Reserve Bank Innovation Hub, Bengaluru, ULI is designed to enable seamless credit access for farmers and MSME borrowers.

- ULI facilitates the flow of digitised financial and non-financial data from various sources to lenders, simplifying credit underwriting and enhancing customer experience.

How ULI Works:

- ULI provides a platform for the frictionless transfer of digital information, including land records, through standardised APIs.

- It simplifies the credit appraisal process, particularly for rural borrowers and those without a credit history, by reducing documentation requirements.

- Lenders can access data from government databases and satellite imagery, making the credit process faster and more efficient.

- The platform supports a ‘plug and play’ model, allowing financial institutions to easily connect and retrieve relevant borrower data.

What is Unified Lending Interface (ULI):

About Unified Payments Interface (UPI):

Associated Article: https://universalinstitutions.com/access-to-rural-credit-challenges-solutions/ |