“RBI WARNS: SLOWER DEPOSITS MAY CREATE LIQUIDITY ISSUES”

Why in the news?

RBI Governor warns that slower deposit growth relative to credit could lead to structural liquidity issues and increased financial risks.

About Bank Credit:

- Source of Funds: Banks use client deposits and investments (e.g., CDs) to lend money.

- Certificates of Deposit (CDs): Offer higher interest rates for locking in funds for a set period.

- Bank Credit: Total funds advanced to borrowers, involving loan agreements.

Bank Credit in India:

- Types:

- Food Credit: Lending to Food Corporation of India (FCI) for foodgrains.

- Non-Food Credit: Major portion, includes credit to agriculture, industry, services, and personal loans.

- Data Collection: Monthly by RBI.

source:researchgate

About Bank Deposits:

Bank Deposits in India: Current Account:

Savings Accounts:

Recurring Deposits:

Fixed Deposits:

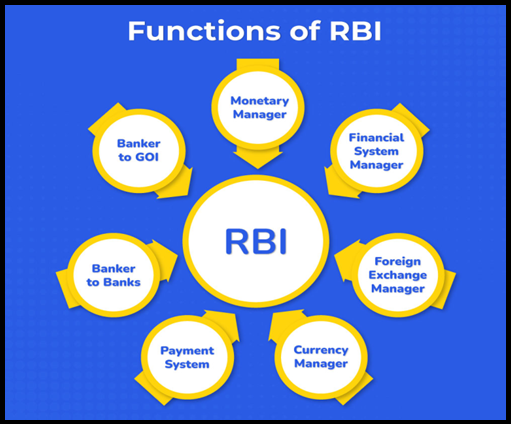

Associated Article https://universalinstitutions.com/rbi-and-monetary-policy-in-india/ |