RBI TO ESTABLISH DIGITAL PAYMENTS PLATFORM TO CURB FRAUD

Why in the news?

- RBI proposes a platform for network-level intelligence and real-time data sharing to curb digital payment frauds.

- RBI plans to include recurring payments like Fastag and National Common Mobility Card (NCMC) in the e-mandate framework.

- To promote quick small-value payments through an on-device wallet, RBI proposes bringing UPI Lite under the e-mandate framework.

- This aims to increase the adoption of UPI Lite for seamless transactions.

About UPI Lite :

- UPI Lite: On-device wallet for offline small-value transactions under ₹200.

- Limits: ₹2,000 wallet limit, no UPI PIN required for payments.

- Phases: Phase 1 – debit offline, credit online; future – fully offline.

- Adding Funds: Enabled via UPI app, requires online mode and additional authentication.

source:fime

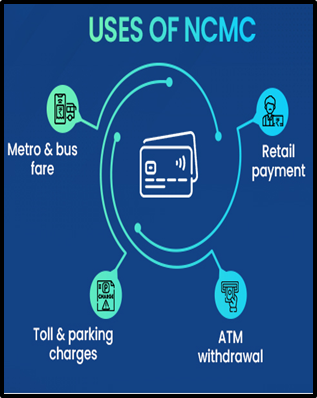

About National Common Mobility Card (NCMC):

Features: ○ Interoperable across transport modes. ○ Contactless NFC transactions. ○ Secure encrypted transactions. ○ Offline low-value transaction capability. ○ Multi-purpose retail payments. Associated Article: https://universalinstitutions.com/national-common-mobility-card-revolutionary-or-fad/ |