RBI TO ALLOW UPI FOR CASH DEPOSIT, ENHANCING BANKING CONVENIENCE.

Why in the news?

RBI plans to enable UPI for cash deposits, permits foreign investment in green bonds, and introduces a mobile app for Retail Direct scheme.

source:fintra

About RBI’s Initiatives for Digital Banking:

- RBI plans to enable Unified Payment Interface (UPI) for cash deposits, acknowledging its popularity and convenience.

- This move aims to enhance customer convenience and reduce cash-handling load in bank branches.

- Operational instructions for implementing UPI-based cash deposit facilities will be issued shortly.

| What is Unified Payments Interface (UPI)?

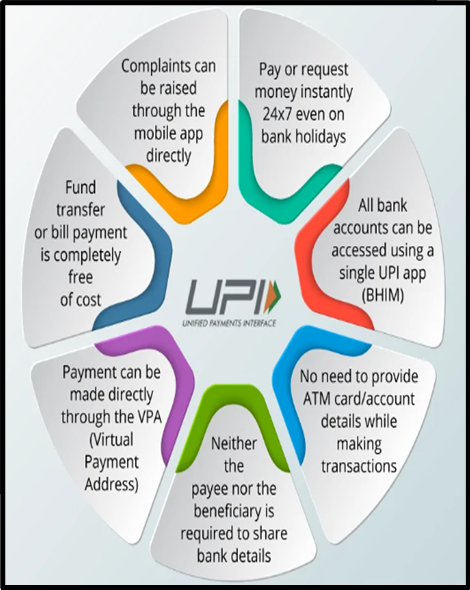

● Digital and real-time payment system developed by NPCI and regulated by RBI. ● Launched on April 11, 2016. ● Enables peer-to-peer inter-bank transfers through a two-click authentication process. Key Features: ● Simplifies transfers using recipient’s UPI ID (mobile number, QR code, or Virtual Payment Address). ● Eliminates the need for entering bank details each time. ● Offers consistent UPI transaction PIN across apps for enhanced cross-operability. ● Utilises technologies like IMPS and AEPS for smooth payments between accounts. ● Facilitates push and pull transactions, barcode payments, and recurring payments such as utility bills and subscriptions. |

Source: