RBI REPORT ON DIGITALISATION AND FINANCE

Why in the news?

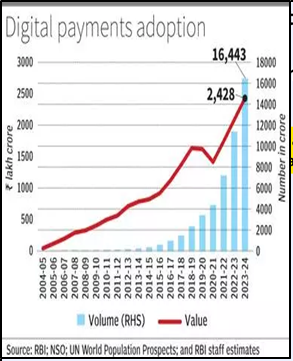

RBI report highlights digitalisation’s benefits and risks, including impulsive spending, data breaches, and cross-border payment system integration.

source:hindustanbussinessline

source:hindustanbussinessline

Cross-Border Payment Systems

- RBI’s UPI integrated with Singapore’s PayNow for faster remittances.

- RBI and Central Bank of UAE signed MoU for interlinking UPI with UAE’s Instant Payment Platform.

- Project Nexus: Multilateral initiative linking UPI with Malaysia, Philippines, Singapore, and Thailand’s FPS.

About Project Nexus:

- About: Multilateral initiative for instant cross-border retail payments by linking domestic FPSs.

- Initiated by: BIS Innovation Hub.

- Goal: Enable global instant cross-border retail payments.

- Objective: Standardise IPS connections, simplifying international payments.

- Founding Members: Malaysia, Philippines, Singapore, Thailand, India; Indonesia joining.

Key Features and Benefits

- Instant Payments: Completes cross-border payments within 60 seconds.

- Single Connection: One connection to Nexus provides access to all network countries.

Recent RBI Developments

- UPI Cash Deposit Facility: Use UPI app at CDMs for cash deposits.

- Third-Party App for PPIs: Allow UPI payments via third-party apps.

- FPIs in Sovereign Green Bonds: Authorise foreign investors for Sovereign Green Bonds.

- Retail Direct Scheme Mobile App: Mobile app for investing in government securities.

- Review of LCR Framework: Enhance liquidity risk management for banks.

|

source:hindustanbussinessline