“RBI LIKELY TO MAINTAIN REPO RATE AMID PERSISTENT FOOD INFLATION”

Why in the news?

- The Reserve Bank of India’s Monetary Policy Committee is likely to maintain the repo rate at 6.5% due to persistent food inflation, signaling a cautious approach to monetary policy.

- Expectations suggest the MPC will keep the monetary policy stance unchanged, focusing on managing inflation and supporting economic growth amid uncertainties.

About Monetary policy:

- Central bank’s macroeconomic policy managing money supply and interest rates.

- Purpose: Achieve macroeconomic goals like controlling inflation, boosting consumption, growth, and liquidity.

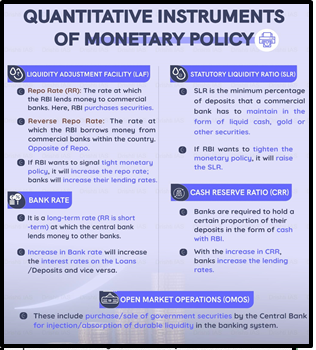

- Tools: Implemented through open market operations (OMOs), bank rate policy, reserve system, credit control, moral persuasion.

- India’s Monetary Policy: RBI aims to manage money quantity to meet sector requirements and spur economic growth.

source:researchgate

About Monetary Policy Committee (MPC):

- Formed under the RBI Act, 1934, amended in 2016 by the Finance Act.

- Purpose: Fix benchmark interest rate, enhance transparency and accountability in monetary policy

- Composition: Six members – three RBI officials, three external members appointed by the Government of India (GoI).

- Chairperson: RBI Governor serves as the ex officio chairperson.

- Mandate: Maintain annual consumer price index-based inflation rate of 4% (+/- 2%).