RBI KEEPS REPO RATE ON HOLD AS FOOD PRICES REMAIN HIGH

Why in the news?

RBI maintains a repo rate at 6.50% due to concerns over high food prices despite moderate overall inflation.

Source:eduprep

About the Concern Over Food Prices:

- RBI remains concerned about the spike in food prices despite a moderation in overall inflation.

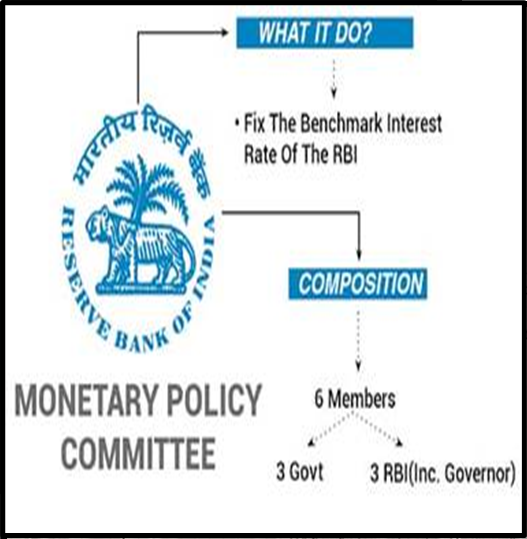

- The Monetary Policy Committee (MPC) decides to keep the policy repo rate unchanged at 6.50%.

- This marks the seventh consecutive time the rates have been held steady.

- MPC emphasises the goal of aligning inflation with the target on a durable basis.

- Satisfaction expressed over progress made in disinflation, but acknowledges the unfinished task.

- RBI Governor Shaktikanta Das, in a post-meeting press conference, highlights the importance of ongoing efforts to tackle inflation.

- Emphasises that while progress has been made, achieving the inflation target remains a priority.

Key Monetary Policy Tools:

○ Percentage of banks’ Net Demand and Time Liabilities kept with the RBI to regulate liquidity.

○ Additional requirement by RBI on banks’ liabilities to manage excess liquidity and stabilise the economy.

○ Interest rate set by RBI for short-term loans to commercial banks, used to control inflation and stimulate economic growth. About Inflation Measures:

○ Sustained increase in general price level of goods and services, reducing purchasing power of money.

○ Total inflation comprises a basket of commodities, including food and fuel.

○ Excludes volatile goods like food and fuel from headline inflation to gauge underlying price trends. |

Source:

https://www.thehindu.com/business/Economy/food-price-uncertainties-to-weigh-on-inflation-trajectory-rbi-retains-fy25-forecast-at-45/article68031679.ece#:~:text=The%20spike%20in%20food%20prices,LAF)%20unchanged%20at%206.50%25.