RBI ASKS NPCI TO CONSIDER PAYTM’S REQUEST FOR TPAP: WHAT IS IT & HOW WILL IT BENEFIT CUSTOMERS?:

Why in the news?

- RBI instructs NPCI to consider Paytm’s request to operate as a Third-Party Application Provider (TPAP) for continued Unified Payments Interface (UPI) functionality.

- TPAP status is essential for providing UPI-based payment services to customers.

source:fintra

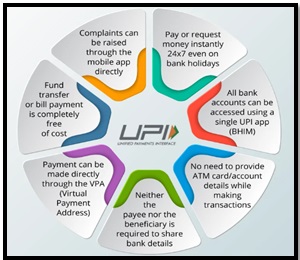

What is TPAP?

- TPAP refers to an entity offering UPI-compliant apps to end-users for facilitating UPI-based payment transactions.

- NPCI may certify 4-5 banks as PSP banks to diversify UPI system risks, ensuring multiple payment app providers participate through a multi-bank model.

Impact of TPAP Approval for Paytm:

- TPAP approval is crucial for Paytm to sustain UPI-based payment services.

- If approved, Paytm’s UPI handles will transition seamlessly to new banks to avoid disruption, per RBI’s instructions.

| What is NPCI?

● NPCI is an umbrella organization overseeing retail payments and settlement systems in India. ● Established under the Payment and Settlement Systems Act, 2007, it operates as a “Not for Profit” Company. ● Initially backed by ten core promoter banks, its shareholding expanded in 2016 to include 56 member banks representing various sectors.

|