Q4 TO WITNESS NIM MODERATION DUE TO TIGHT LIQUIDITY CONDITIONS.

Why in the news?

Banks anticipate NIM pressure in Q4 due to tight liquidity conditions and higher funding costs, impacting profitability.

source:IE

source:IE

Understanding the Factors Affecting NIM:

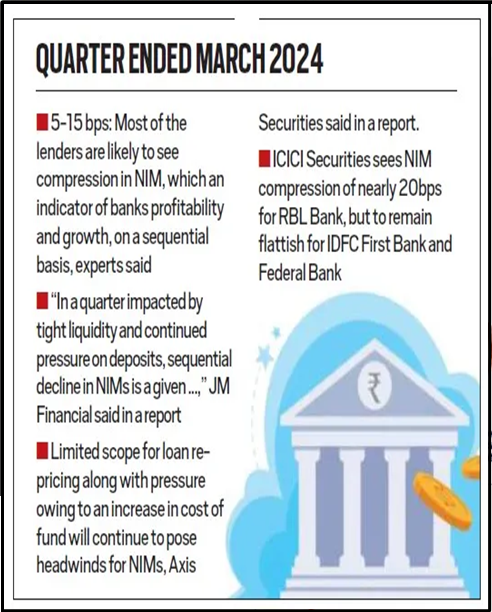

- Tight liquidity conditions and higher funding costs are expected to impact banks’ net interest margins (NIM) in Q4.

- Analysts predict a 5-15 basis points compression in NIM for most lenders due to limited loan repricing and increased cost of funds.

- Private banks are particularly susceptible to sequential declines in NIM amid ongoing liquidity challenges.

What is Net Interest Margin?

- NIM stands for Net Interest Margin.

- It represents the variance between a bank’s interest income and the interest paid relative to its interest-earning assets.

- Reflects profitability and efficiency in managing interest rate risk.

What is Banking System Liquidity?

- Definition:

- Refers to readily available cash banks required for short-term business and financial needs.

- Measurement:

- Deficit: Banking system borrows from RBI under Liquidity Adjustment Facility (LAF).

- Surplus: Banking system lends to RBI under LAF.

Liquidity Adjustment Facility (LAF):

- RBI’s operations to inject or absorb liquidity into/from the banking system.

|

Source:

https://indianexpress.com/article/business/banking-and-finance/banks-to-see-moderation-in-nim-in-q4-on-tight-liquidity-condition-9270252/#:~:text=Banks%20are%20likely%20to%20see,conditions%20and%20higher%20funding%20cost.

source:IE