Q. Despite the risks associated with crypto assets, their underlying advantages should not be overlooked. Discuss.

Approach:

- Briefly write about crypto assets in the introduction.

- Highlight the risks associated with it.

- Provide its underlying advantages.

- Conclude by suggesting actionable recommendations.

Answer:

Crypto assets are digital assets, which utilize cryptography, peer-to-peer networking, and a public ledger to regulate the generation of new units, verify the transactions, and secure the transactions without the intervention of any middleman. They include cryptocurrencies, utility tokens, platform tokens, and tokenized securities.

As per IMF, the market capitalization of crypto assets has almost tripled in 2021 to an all-time high of $2.5 trillion but they present several risks, such as:

Risks due to absence of formal governance structure

- Because of limited or inadequate disclosure and oversight, investors always remain at substantial risk.

- Anonymity of crypto assets creates data gap for regulators, and opens door for money laundering, terrorist funding and other illicit transactions.

- Different countries have different regulatory frameworks for crypto assets. Hence, coordination becomes difficult.

Risks associated with financial stability

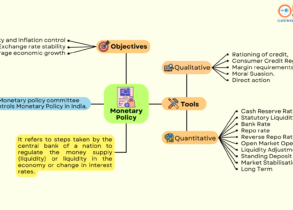

- They lead to a phenomenon called Cryptoization i.e., reduction in the ability of the central banks to effectively implement monetary policy. Hence, it creates financial stability risks.

- Increased demand may facilitate tax evasion, reduce the profits out of seigniorage for the government, and can also lead to capital outflow impacting foreign exchange market. Thus, it poses a threat to fiscal policy.

Cyber-security risks

- Not only centralized elements of the ecosystem (such as wallets and exchanges) can be hacked, but even the consensus algorithms that underpin the operation of block-chains.

Despite all these risks, crypto assets offer a new world of opportunities as discussed below.

Creative Disruption

- Blockchain technology may change the way the content is produced, distributed and consumed in the future, because it is decentralized, secure, stable, traceable, transparent, fast and reliable. Innovative financial services and business models can emerge around it

Recognition as a means of exchange

- It has the potential of becoming an acceptable means of payments and settlements. Their increased usage may also promote inclusive access to previously “unbanked” parts of the world.

Tokenization

- Creation of digital, tokenized representations of assets that are issued, traded and managed on a block-chain can reduce friction and overhead costs associated with the issuance, transfer, and management of assets such as securities, commodities, and real estate assets.

Potential for India

- India can take leverage of its IT boom to tap the growth in this industry through crypto-startups, Software technology parks (STPs) and special economic zones (SEZs).

Therefore, Creative ‘crypto export zone’ schemes can incubate clusters of excellence and create world-class financial services firms and unicorns in India. A new world of finance is emerging in which transacting in crypto assets may become standard procedure. In this context, global coordination and consensus would also be required on key regulatory issues.