PROPER DISCLOSURES IN SHORT-SELLING

Why in the News?

- Securities and Exchange Board of India (Sebi) reinforces stringent short-selling compliance rules for all investor classes.

- The rules, initially introduced in 2007, are now explicitly included in Sebi’s latest short-selling master circular.

Source: Wallstreet Mojo

About Short-Selling Guidelines:

- Clarifies the nature of short-selling, involving selling borrowed securities or those already owned.

- Explicitly prohibits “naked short-selling,” where stocks are sold without proper borrowing arrangements.

- Mandates upfront disclosure regarding involvement in short-selling.

- Requires retail investors engaging in short-selling to furnish disclosures by the end of the trading day.

| Short Selling

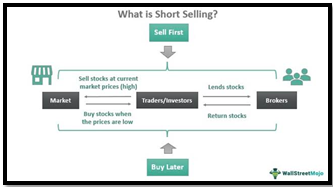

· Definition: Short selling is a trading strategy where investors sell borrowed securities with the expectation of buying them back later at a lower price. · Borrowing Securities: Investors borrow stocks to sell, anticipating a decline in their value. · Profit from Decline: The goal is to profit from the subsequent price drop, allowing repurchase at a lower cost. · Risks: Involves risks, as losses can occur if the stock’s value rises. |

Source: Wallstreet Mojo

Source: Wallstreet Mojo