POLITICAL LANDSCAPE AND BUDGET CONSIDERATIONS

Why in the news?

- The upcoming Union budget is crucial due to a changed political landscape, unexpected revenue surplus, and pressing economic challenges.

- The fractured election verdict and upcoming state elections may influence budget proposals.

- The government might focus on welfare programs and social sector spending to regain narrative control.

source:slideshare

Key points: The Union Budget of India

- Since 2017-18, the Union Budget is presented on February 1.

- Previously, it was presented in late February.

- The Railway Budget merged with the General Budget in 2017-18.

- The Budget Division of the Department of Economic Affairs prepares the Union Budget.

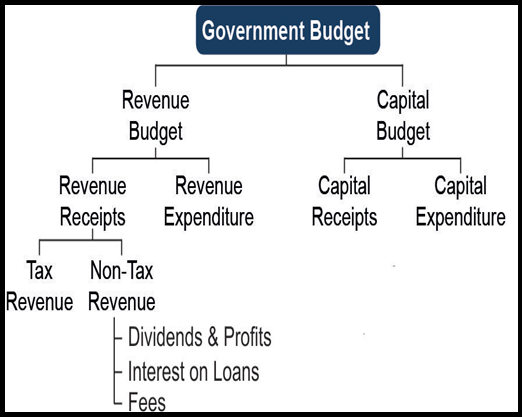

Types of Government Budget

- Balanced Budget

- Receipts equal expenditures.

- Moderately increases aggregate demand.

- Recommended near full employment.

- Surplus Budget

- Receipts exceed expenditures.

- Reduces aggregate demand.

- Recommended during large inflationary gaps.

- Deficit Budget

- Expenditures exceed receipts.

- Increases aggregate demand.

- Recommended during economic depression.

About Union Budget of India:

Associated Article: https://universalinstitutions.com/global-minimum-tax-will-the-budget-offer-a-roadmap/ |