ON THE UPSIDE

(REVIVAL OF PRIVATE INVESTMENT)

Syllabus:

GS 3:

- Investment Models.

- Indian Economy and issues relating to Growth and Development.

Why in the News?

- India’s economic trajectory continues to outperform expectations, registering a robust 7.6% GDP growth in the National Statistical Office’s second advance estimate, surpassing earlier projections.

- This resilience, coupled with a government focus on fiscal consolidation, is pivotal for sustaining high growth rates.

Source: The Print

GDP Growth Dynamics:

- Surprising Upside:

- The revised GDP growth of 7.6% for the fiscal year signifies a positive economic momentum, driven by additional data and rising net taxes.

- Gross value added, excluding net tax impact, grew slightly lower at 6.9%.

- Year-End Projection:

- With the first three quarters averaging an 8.2% growth, the implied fourth-quarter growth is 5.9%.

- Despite being below pre-pandemic levels, India’s economy is on a trajectory towards 7% growth.

| Understanding Advance Estimates

Advance estimates of GDP are pivotal for economic planning and policy formulation. They provide early insights into the anticipated performance of key sectors, aiding decision-making processes. Formation Process: · Data Evaluation: Central Statistics Office (CSO) formulates advance estimates by analyzing data from previous years and conducting surveys across various ministries. · Sector-Specific Estimates: Advance estimates cover various sectors, including agriculture and horticulture, projecting production for the upcoming fiscal year. · Timeline: These estimates are released months before the end of the financial year, providing timely insights for planning and policy formulation. Types of Advance Estimates: 1. 1st Advance Estimates: Typically released in early January, these estimates set the initial forecast for GDP growth in the upcoming fiscal year. 2. 2nd Advance Estimates: Published in the last week of February, these estimates follow the annual budget announcement and provide updated GDP growth projections. 3. 3rd Advance Estimates: Specifically focusing on agriculture and horticulture, these estimates offer sector-specific insights based on data from states and surveys. 4. 4th Advance Estimates: The final quarterly estimates before the end of the financial year, these projections offer a comprehensive overview of agriculture production. Significance of Advance Estimates: · Budget Allocation: Advance estimates guide the finance ministry in allocating budgetary resources effectively. · Economic Planning: They offer a broad overview of the economy’s expected performance, aiding in policy formulation and decision-making processes. |

Factors Influencing Growth:

- Strengthened bank and corporate balance sheets contribute to improved growth performance.

- The government’s infrastructure focus enhances growth potential.

- The Reserve Bank of India (RBI), projecting a 7% GDP growth for the next year, faces limitations due to high-interest rates and reduced fiscal impulse, potentially normalizing demand and net tax impact.

Private Consumption and Savings Analysis:

- Consumption Trends:

- Private consumption growth at 3% lags behind overall GDP growth.

- Rural consumption, affected by high food inflation, particularly suffers, impacting discretionary spending.

- Shifting Consumption Patterns:

- Data reveals a shift in household consumption towards non-food items, reflecting rising per capita income.

- Adjusting consumer price index weights becomes crucial, considering these changing consumption patterns.

- Savings Overview:

- Household savings, comprising 61% of total savings, have seen a decline in their GDP share to 18.4%.

- Net financial savings witness a dip, while physical savings rise, reflecting increased borrowings for acquiring assets like houses.

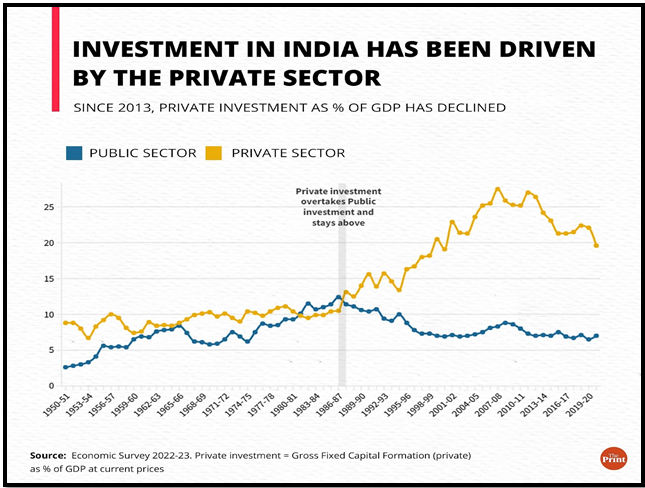

Investment Scenario:

- Corporate Investments:

- Comprehensive data on investments reveals public and household investments as leading contributors in fiscal 2022-23.

- Private corporate investment remains stagnant, highlighting the need for a definitive revival.

- Current Fiscal Dynamics:

- The ongoing fiscal year sees signs of corporate investment picking up, driven by the Production-Linked Incentive (PLI) scheme, especially in pharmaceuticals and electronics.

- The shift towards core/capital-intensive segments is anticipated.

Government Initiatives to Attract Investments

Empowered Group of Secretaries (EGoS) and Project Development Cells (PDCs):

- Establishment: EGoS and PDCs set up by the Union Cabinet to expedite investments in collaboration with state governments.

- Objective: To enhance India’s pipeline of investable projects and attract more FDI and domestic investments.

National Monetization Pipeline (NMP):

- Launch: Introduced in 2021 to showcase available investment opportunities in infrastructure.

- Value: Over four years, the NMP’s indicative value for the Central Government’s core assets is estimated at Rs. 6 lakh crore.

Business Reforms Action Plan:

- DPIIT’s Business Reforms Action Plan ranks states/UTs based on their implementation of reform parameters.

- Reform Areas: The Business Reforms Action Plan by DPIIT streamlines rules, focuses on key areas, and ranks states and UTs based on designated reform parameters.

Investor-Friendly Strategy:

- Accessible FDI: Majority of sectors allow 100% FDI under the automatic route.

- Policy Revision: FDI policy is regularly updated after extensive consultations with stakeholders to maintain India’s attractiveness for investors.

Four Labour Codes:

- Streamlining: Government has consolidated 29 Central Labour Laws into four codes to simplify conducting business.

- Codes: Includes the Code on Wages, Industrial Relations Code, Code on Social Security, and Code on Occupational Safety, Health, and Working Conditions.

Concessional Tax Rate:

- Extension: Concessional tax rate of 15% extended to new domestic companies setting up manufacturing units until March 31, 2024.

India Industrial Land Bank (IILB):

- Introduction: GIS-based portal providing comprehensive industrial infrastructure-related information.

- Features: Includes connectivity, infrastructure details, terrain information, vacant plot details, line of activity, and contact information.

Phased Manufacturing Programme (PMP):

- Promotion: Launched to promote domestic manufacturing of electric vehicles and related components.

- Objective: Encourage indigenous production of assemblies, sub-assemblies, parts, and inputs.

National Single Window System (NSWS):

- Launch: Introduced to streamline approvals and clearances for investors through a single window.

- Benefits: Enhances transparency, accountability, and responsiveness in the ecosystem.

PLI schemes

- Impact: Aimed at generating additional production worth Rs. 30 lakh crore and creating employment opportunities for 60 lakh people over the next five years.

Way Forward:

- Corporate Sector Preparedness: The private corporate sector, poised for investments, could benefit from reduced policy uncertainty and compliance costs, fostering a conducive environment for economic growth.

- Revival of Private Investments: A broad-based revival of private investments becomes crucial for sustained high growth rates, especially as the government moderates its investments, emphasizing fiscal consolidation.

Conclusion:

India’s economic landscape exhibits resilience and growth potential, driven by strengthened fundamentals. A strategic focus on private investments, coupled with addressing policy uncertainties, is imperative for navigating the path to sustained economic prosperity.

Source:

Mains Practice Question:

Analyse the challenges and opportunities associated with private sector revival and its implications for India’s economic trajectory.