ON IRREGULARITIES IN VERTICAL DEVOLUTION

Why in the news?

- Recent demonstrations by the Kerala and Karnataka administrations in New Delhi spotlight deficiencies in India’s fiscal federalism.

- The 16th Finance Commission must address historical shortcomings in vertical devolution by providing compensations to states.

source:toi

Key Recommendations of 15th Finance Commission:

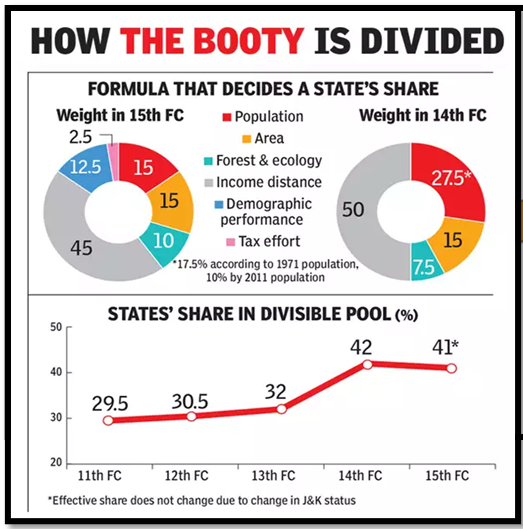

- 15th Finance Commission recommends a 41% share of central taxes for states from 2021-26.

- Horizontal devolution includes weightage for demographic performance, income, population, area, forest, ecology, tax, and fiscal efforts.

- Post-devolution revenue deficit grants totaling around Rs. 3 trillion suggested.

- Performance-based incentives focus on the social sector, rural economy, governance, and power sector.

What is Tax Devolution ?

About the 15th Finance Commission: ● Constitutional body for distributing tax proceeds between Centre and states. ● Constituted every five years under Article 280. ● Chaired by NK Singh, formed in November 2017. ● Recommendations span from 2021-22 to 2025-26. |