NO BUYERS FOR J&K’S LITHIUM

Syllabus:

GS 3:

- Indian Economy and issues relating to Planning, Mobilization of Resources, Growth, Development and Employment.

Why in the News?

The Ministry of Mines has scrapped the auction for J&K’s lithium block in Reasi for the second time due to weak investor response, highlighting challenges in extraction, processing, and reporting standards that deter potential investors from this significant lithium deposit.

Source: Dailydata

Overview and Context:

- Auction Scrapped Again: The Ministry of Mines has scrapped the auction for the lithium block in J&K’s Reasi district for the second time due to weak investor response.

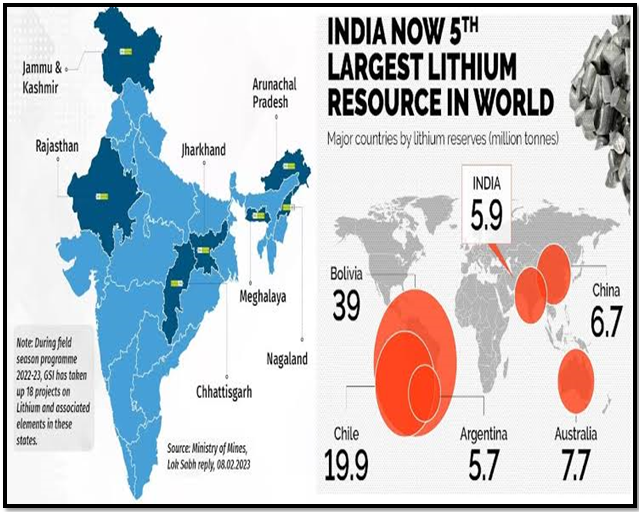

- Initial Optimism Fades: Initially hailed as a significant discovery, the inferred deposit of 5.9 million tonnes of lithium ore in Reasi now faces a sobering reality due to lack of investor interest.

- Exploration Needed: Officials are considering further exploration to better understand the lithium deposit before attempting another auction, as the initial excitement has waned.

- Investor Hesitance: Difficulty in extracting and processing lithium from hard rock pegmatite deposits, coupled with sub-par mineral reporting standards, has deterred potential investors.

- Limited Information: The auction documents provided limited information, making it challenging for bidders to assess the block’s feasibility, contributing to the auction’s failure.

- Need for Improvement: Experts suggest adopting internationally recognized reporting standards to attract private investment, as current standards do not adequately determine economic viability.

| About Lithium

About:

Extraction:

Uses:

Major Global Lithium Reserves:

Lithium Reserves in India:

|

Why Were the Auctions Scrapped?

- First Auction Failure: The first auction was annulled on March 13 due to fewer than three bidders clearing the first round, prompting the Mines Ministry to attempt a second auction.

- Second Auction Failure: Despite waiving the minimum bidder requirement for the second auction, it also failed to attract any qualified bidders, resulting in another annulment.

- Initial Attempt Issues: During the first auction attempt, prospective bidders complained about limited information and the block being too small to apply modern mineral systems-based tools.

- Lack of Beneficiation Studies: The absence of beneficiation studies to assess the feasibility of extracting and processing lithium further discouraged potential bidders from participating.

- Shift to Better Standards: Representatives from the Vedanta Group suggested the Mines Ministry shift to an investor-friendly resource classification code during a stakeholder meeting.

- Further Exploration Considered: The Ministry is now considering further exploration to provide more clarity on the resource before attempting another auction, hoping to attract better investor response.

Why Have Investors Kept Their Distance?

- Extraction Difficulties: Mining industry experts highlight the challenges of extracting and processing lithium from hard rock pegmatite deposits found in Reasi as a significant deterrent.

- Reporting Standards: Underdeveloped mineral reporting standards in the auction documents played a critical role in keeping investors away, as they lacked detailed information.

- Economic Viability: Current resource classification rules do not provide sufficient information to determine the economic viability of mining a mineral block, particularly for expensive extraction processes.

- Global Standards: Most mining companies and regulatory bodies adhere to the Committee for Mineral Reserves International Reporting Standards (CRIRSCO), which provides higher geological confidence.

- Call for Compliance: To attract private investment, experts recommend India adopt CRIRSCO-aligned mineral reporting standards to provide clearer economic viability and geological confidence.

- Investment Deterrent: Without compliant resource/reserve reports, auctions may not yield desired results, and successful bidders may not commence work due to uncertainty in resource viability.

Why is There a Need to Improve Reporting Standards?

- Economic Viability Clarity: Improved reporting standards would provide clarity on the economic viability of mining lithium, essential due to the high extraction costs and fluctuating global prices.

- Global Compliance: Adopting internationally compliant standards like CRIRSCO ensures detailed and reliable information, attracting more investors to participate in the auctions.

- High Geological Confidence: CRIRSCO standards require high geological confidence confirmed through studies to at least a pre-feasibility level, providing investors with more assurance.

- Competitive Edge: Aligning with global standards would make India more competitive in the mining sector, attracting significant private investment and enhancing resource development.

- Regulatory Alignment: Compliance with internationally recognized standards aligns with global practices, facilitating smoother investment processes and reducing uncertainty for investors.

- Boosting Investor Confidence: Improved reporting standards would boost investor confidence, ensuring that mineral blocks are economically viable and reducing the risk of unsuccessful auctions.

What Can We Expect Next?

- Further Exploration: If the government decides to proceed with further exploration of the Reasi block, new findings may provide potential investors with better clarity on the resource.

- Government-Run Operations: Alternatively, the government may choose to reserve the area for prospecting or mining operations through a government-owned company, as permitted under the MMDR Act.

- Expert Endorsement: P.V. Rao supports allocating blocks that did not receive minimum bids to government companies to prioritize developing and mining critical minerals.

- Re-auction Attempts: The Mines Ministry plans to re-offer some blocks in a second attempt, similar to the Reasi lithium block, and intends to re-offer many more in the future.

- Successful Auctions: The recent successful auction of India’s first lithium block in Chhattisgarh’s Korba district indicates potential for better outcomes with improved processes.

- Challenges in Other States: Lithium exploration in other states like Manipur and Ladakh has faced local resistance and discouraging results, highlighting the need for better exploration and reporting practices.

Way Forward

- Enhanced Exploration: Conduct thorough geological and feasibility studies to better understand the lithium deposit, ensuring accurate data for future auctions.

- Improved Reporting Standards: Adopt internationally recognized mineral reporting standards, such as CRIRSCO, to provide detailed and reliable information to potential investors.

- Incentivize Investments: Offer attractive incentives and financial support to investors willing to participate in the lithium mining sector, reducing initial investment risks.

- Government-Led Development: Reserve critical mineral blocks for government-owned companies to ensure development and prioritize the extraction of vital resources.

- Public-Private Partnerships: Foster collaborations between government entities and private companies to leverage expertise, technology, and investment for efficient resource development.

- Local Engagement: Address local concerns and engage with communities to ensure smooth exploration and mining operations, avoiding resistance and delays.

- Technology Adoption: Invest in advanced extraction and processing technologies to overcome the challenges associated with hard rock pegmatite deposits.

- Regulatory Framework: Strengthen the regulatory framework to streamline the auction process, enhance transparency, and build investor confidence in the sector.

Conclusion

The recurring cancellation of auctions for J&K’s lithium block underscores the need for improved exploration, reporting standards, and investor incentives. Addressing these issues is crucial to harnessing India’s lithium potential, reducing dependency on imports, and advancing the country’s strategic mineral resource development.

Source:Indian Express

Mains Practice Question:

Discuss the challenges faced in the auction and extraction of lithium deposits in India, particularly in Jammu and Kashmir. Suggest measures to overcome these challenges to ensure successful exploitation of this critical mineral.

Associated Article: