Nil Tax Slab Increased to ₹12 Lakh Limit

Why in the news?

The Union Budget 2025 raised the Nil Tax Slab to ₹12 lakh, offering tax-free income up to ₹12.75 lakh for salaried individuals, along with new tax slabs to reduce the financial burden on taxpayers.

Key Highlights:

- Finance Minister Nirmala Sitharaman presented the first full-fledged budget of the NDA government’s third term in the Lok Sabha.

- The Nil Tax Slab has been extended to cover annual incomes up to ₹12 lakh.

- Salaried individuals can avail a ₹75,000 standard deduction, making incomes up to ₹12.75 lakh tax-free.

Revised Tax Structure

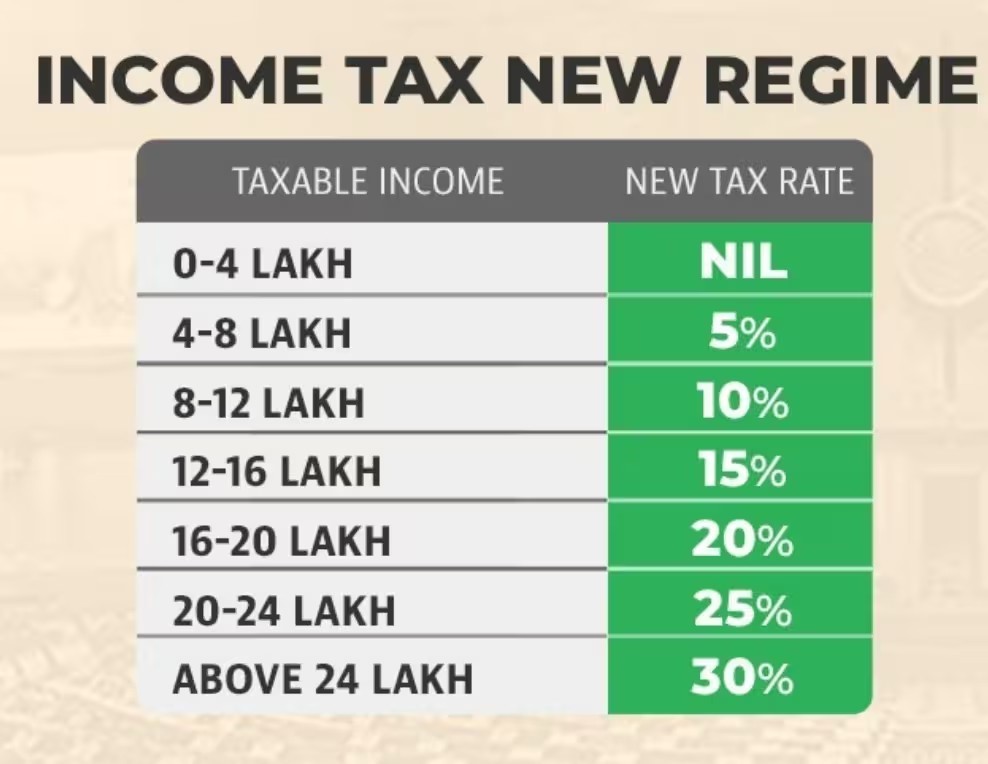

- New tax slabs were introduced under the new tax regime.

- Income up to ₹4 lakh will not attract any tax.

- Additional tax slabs offer structured benefits for different income categories.

Significance and Impact

- The tax revisions aim to boost disposable income for the middle class, promoting higher consumption.

- It provides relief for salaried individuals by reducing their tax burden.

- The restructuring of tax slabs aligns with the government’s focus on taxpayer welfare and economic growth stimulation.

Union Budget 2025-26: Key Highlights

Theme & Focus Areas

- Theme: “Sabka Vikas”

- Focus: Zero poverty, quality education, healthcare, skilled employment, women’s economic participation, and farmers’ prosperity.

Growth Engines of Development

- Agriculture: PM Dhan-Dhaanya Krishi Yojana, Kisan Credit Card limit raised to ₹5 lakh.

- MSMEs: ₹2 crore loans for SC/ST & women entrepreneurs.

- Investment: ₹1.5 lakh crore interest-free loans for states.

- Exports: BharatTradeNet (BTN) for seamless digital trade.

Tax Reforms

- No tax up to ₹12 lakh; ₹75,000 standard deduction for salaried individuals.

New Schemes

- PM SVANIDHI: UPI-linked credit card loans.

- Nuclear Energy Mission: ₹20,000 crore for Small Modular Reactors.

These budgetary changes reflect a strategic move to improve public purchasing power and strengthen the overall financial ecosystem of the country.