NEW BANKING REPORTING NORMS TO ENHANCE POLICY ACCURACY

Why in the news?

Finance Minister Nirmala Sitharaman announced amendments to banking laws, emphasising new reporting norms to improve data accuracy for policy-making and introducing customer-friendly nomination provisions.

source:slideshare

About the new reporting norms and amendments:

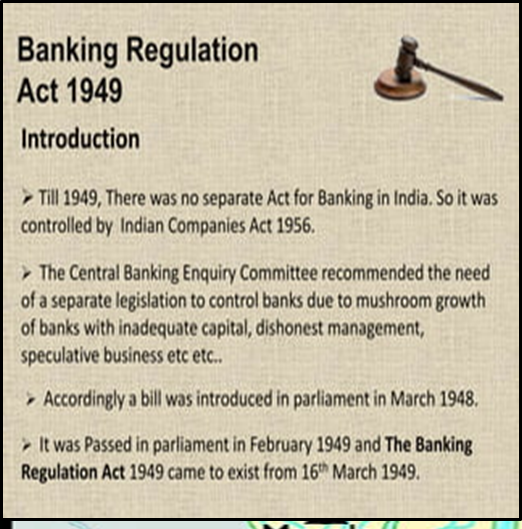

- Finance Minister Nirmala Sitharaman emphasized the importance of new reporting norms for banks as part of the amendments to the Banking Regulation (BR) Act.

- The changes will allow for data used in policy-making to be more accurate and reflective of current realities, aiding informed decision-making.

- A significant amendment includes shifting reporting dates for banks to the 15th and 30th of each month, enabling regular updates and reducing the need for major year-end adjustments.

Customer-Friendly Provisions:

- The introduction of provisions for simultaneous and successive nominations by account holders and depositors in the BR Act is highlighted as a customer-friendly measure.

- This change provides customers with more options in nominating beneficiaries, ensuring nominees can more easily claim what is rightfully theirs.

| Section 42 of the Reserve Bank of India Act, 1934: Key Points

Mandatory Cash Reserves:

Calculation of Balance:

Exclusions from Liabilities:

Specific Exclusions for State Cooperative Banks:

Reductions in Aggregate Liabilities:

Associated Article: https://universalinstitutions.com/the-banking-system-in-india/ |