NAVIGATING REGULATORY OVERHAUL : RBI’S DRAFT RULES FOR PAYMENT AGGREGATORS”

Syllabus:

GS 3:

- Effects of Liberalization on the Economy

- Indian Economy and issues relating to Planning.

- Growth and Development.

Why in the News?

The Reserve Bank of India (RBI) released draft rules for payment aggregators (PAs) in response to the need for better regulation, particularly in offline payment transactions.

Source: ET

About the Rules:

- These regulations aim to extend existing guidelines to cover offline transactions, ensuring synergy in regulation and addressing concerns about transparency and safety within the ecosystem.

- The draft rules were issued following consultation papers floated by the RBI to gather feedback and inputs from stakeholders.

- The objective is to create a robust regulatory framework that fosters trust, transparency, and efficiency in payment aggregation services.

- The proposed regulations reflect the RBI’s commitment to promoting financial stability and consumer protection in the digital payments landscape.

| Payment Aggregator

Overview:

Functions:

Key Features:

Types of Payment Aggregators: 1. Bank Payment Aggregators:

2. Third-Party Payment Aggregators:

RBI’s Criteria for Approval:

|

Need for Regulation:

- The RBI identified the need for better regulation of offline payment aggregators (PAs) following concerns about transparency and safety in offline transactions.

- Consultation papers were floated to solicit feedback on proposed guidelines, focusing on activities of offline PAs and strengthening Know Your Customer (KYC) procedures and due diligence.

- The proliferation of digital payment platforms and the increasing volume of offline transactions underscored the urgency of regulating payment aggregators comprehensively.

- Ensuring uniform standards across online and offline payment aggregators is essential to maintain the integrity and security of the payment ecosystem.

- The draft regulations aim to address emerging risks and vulnerabilities associated with offline payment transactions, aligning regulatory oversight with technological advancements.

Proposed Norms:

- Payment aggregators facilitate payments from customers to merchants, relieving merchants from the burden of creating their own payment integration systems.

- The draft guidelines propose extending existing regulations to cover offline transactions, aligning regulations for both online and offline activities of PAs.

- Lessons from the Paytm Payments Bank crisis were incorporated, emphasizing the importance of adherence to KYC norms and avoiding illegal activities.

- The proposed norms aim to enhance transparency, accountability, and risk management practices among payment aggregators, promoting trust and confidence in the ecosystem.

- Clear guidelines on data protection, customer grievance redressal, and dispute resolution mechanisms are integral to safeguarding consumer interests and promoting fair practices.

Compulsory Registration:

- Non-bank PAs, especially those operating offline, may require separate authorization from the RBI, while banks providing physical PA services do not need separate authorization.

- Non-banking entities engaged in point-of-sale (PoS) activities must inform the RBI about their intent to seek authorization within a specified timeframe.

- Failure to comply with authorization requirements may lead to the cessation of operations by a certain deadline.

- The registration process aims to streamline oversight and ensure that all entities operating in the payment aggregation space adhere to regulatory standards.

- Establishing a clear regulatory framework will help mitigate risks associated with unauthorized or unregulated payment aggregators, protecting consumers and promoting market integrity.

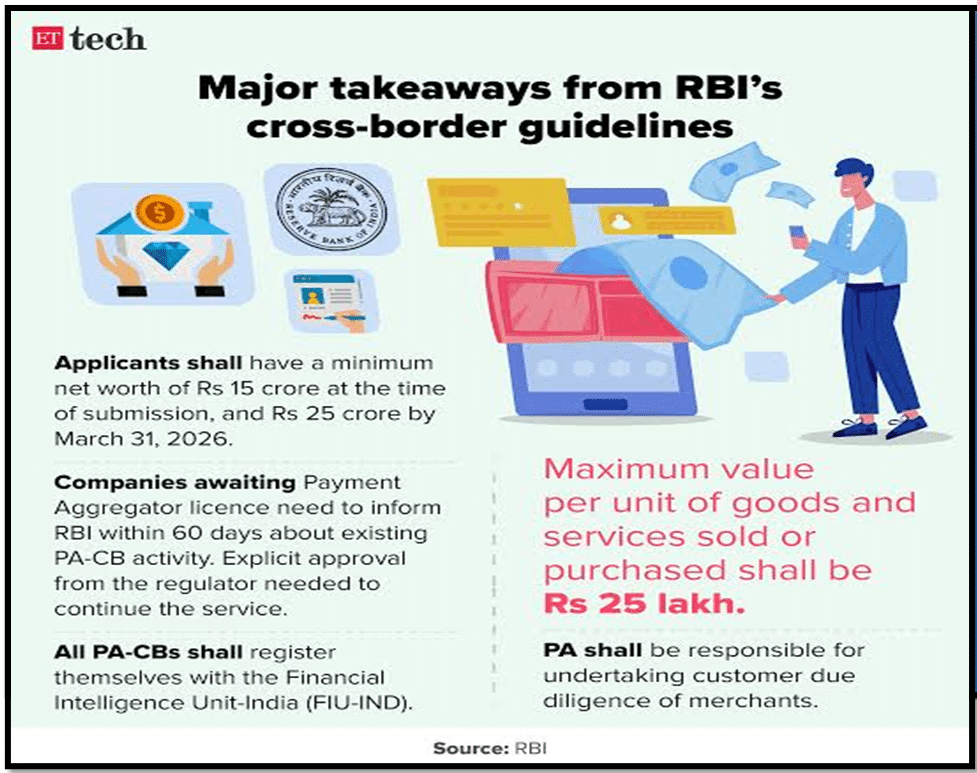

Sustainability Requirements:

- Non-banking entities providing proximity/face-to-face transaction services must meet minimum net worth requirements, with a proposed increase in net worth by a specified deadline.

- Existing offline operators unable to comply with authorization requirements may be required to wind up their operations by a certain date.

- Stricter net worth requirements aim to enhance financial resilience and stability among payment aggregators, reducing the likelihood of financial distress or insolvency.

- Regulatory oversight ensures that payment aggregators maintain adequate capital buffers to absorb potential losses and meet financial obligations.

- Compliance with sustainability requirements is essential for fostering investor confidence, promoting market discipline, and safeguarding financial stability.

KYC Requirements:

- Proposed regulations categorize merchants into small and medium categories based on annual business turnover, with different verification requirements for each category.

- Payment aggregators must ensure that transactions conducted by merchants are consistent with their business profile and assign risk-based payment limits accordingly.

- Enhanced KYC requirements aim to mitigate the risk of fraud, money laundering, and other illicit activities in the payment aggregation space.

- Rigorous due diligence measures promote transparency and accountability in merchant onboarding processes, reducing the likelihood of fraudulent transactions.

- Effective KYC procedures are essential for building trust and credibility in the payment ecosystem, attracting legitimate businesses and fostering sustainable growth.

Data Storage Provisions:

- Entities other than card issuers and networks are prohibited from storing data for proximity/face-to-face payments after a certain date, with limited exceptions for tracking and reconciliation purposes.

- Payment aggregators are allowed to store limited data, such as the last four digits of the card number and the issuer’s name, for transaction tracking and reconciliation.

- Stricter data storage provisions aim to enhance data security and privacy, reducing the risk of unauthorized access or misuse of sensitive information.

- Clear guidelines on data retention and disposal help mitigate cybersecurity risks and ensure compliance with data protection regulations.

- Transparent data storage practices foster trust and confidence among consumers, promoting the adoption of digital payment solutions and driving financial inclusion.

Challenges to Implementation:

Compliance Burden: Non-banking entities may face challenges in meeting the regulatory requirements, such as minimum net worth criteria and enhanced KYC procedures, within the specified timelines.

Technological Upgradation:

Implementing new regulations may necessitate significant investments in technology infrastructure and systems upgrades to ensure compliance with data storage provisions and risk management frameworks.

Operational Disruptions:

Transitioning to the new regulatory framework could result in operational disruptions for payment aggregators, especially those operating offline, impacting their ability to serve merchants and customers effectively.

Regulatory Compliance Costs: Compliance with the proposed regulations may entail increased costs for non-banking entities, including registration fees, ongoing monitoring expenses, and investments in compliance-related activities.

Stakeholder Engagement:

Ensuring buy-in and cooperation from all stakeholders, including payment aggregators, banks, merchants, and consumers, will be crucial for successful implementation and enforcement of the new regulations.

Way Forward:

Capacity Building: Providing guidance, training, and support to non-banking entities to enhance their capacity for regulatory compliance and risk management.

Stakeholder Collaboration:

Encouraging collaboration and dialogue among regulators, industry participants, and other stakeholders to address implementation challenges and streamline processes.

Technology Innovation:

Promoting innovation in financial technology to develop scalable and cost-effective solutions for regulatory compliance, data security, and customer authentication.

Continuous Monitoring:

Establishing robust monitoring mechanisms to track compliance with regulatory requirements and identify emerging risks or gaps in implementation.

Review and Adaptation:

Conducting periodic reviews and assessments of the regulatory framework to ensure its effectiveness, relevance, and alignment with evolving industry dynamics and technological advancements.

Conclusion:

- The draft regulations for payment aggregators represent a significant step towards enhancing transparency and safety in offline payment transactions.

- While the proposed norms aim to address existing gaps and vulnerabilities in the ecosystem, their effective implementation will require concerted efforts from all stakeholders.

Source:The Hindu

Mains Practice Question:

Discuss the significance of the Reserve Bank of India’s draft regulations for payment aggregators in addressing challenges and ensuring transparency in offline payment transactions. Evaluate the potential impact of these regulations on the financial ecosystem in India.