Liberalised Remittance Scheme (LRS)

Context: At the time of moving the Finance Bill 2023 for consideration and passage in the Lok Sabha, Finance Minister Nirmala Sitharaman said the Reserve Bank has been asked to look into ways to bring credit card payments on foreign tours under the Liberalised Remittance Scheme (LRS).

What is LRS?

- Under LRS, you can spend money in foreign countries for education, purchase of assets like shares and property, tourism, medical treatment and more.

- One can also spend for the maintenance of relatives living abroad, gifts and donations.

- The person can open and maintain foreign currency accounts with overseas banks for carrying out transactions.

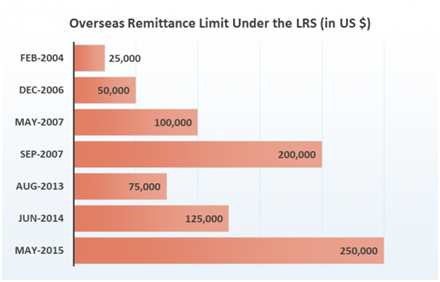

- The LRS, introduced in 2004, initially permitted an outflow of USD 25,000. The LRS limit has been revised in stages consistent with prevailing macro and micro economic conditions and at present the permitted limit is up to USD $250,000 per financial year.

- Only individual Indian residents are permitted to remit funds under LRS. Corporates, partnership firms, HUF, trusts and Charitable Trusts are excluded from its ambit. However, it is available to minors, provided that Form A2 is countersigned by the minor’s natural guardian.

- The rules clearly mention that one can remit foreign exchange (forex) only for any permissible current account transactions or capital account transactions or a combination of both.

- Under LRS, the following types of transactions are expressly prohibited:

- Transactions not permissible under Foreign Exchange Management Act, 1999

- Remittance for margins or margin calls to overseas exchanges or overseas counterparty

- Remittance for trading in foreign exchange abroad. Hence statement 1 is not correct.

- Remittances for any purpose specifically prohibited under Schedule I or any item restricted under Schedule II of Foreign Exchange Management (Current Account Transaction) Rules, 2000

- Capital account remittances to countries identified by Financial Action Task Force (FATF) as non-co-operative countries and territories or as notified by RBI

- Remittances directly or indirectly to those individuals and entities identified as posing a significant risk of committing acts of terrorism as advised separately by RBI to the banks

| Practice Question

1. What is the Liberalised Remittance Scheme (LRS)? Which transactions are prohibited under the scheme? |