Is universal basic income feasible for India?

Syllabus:

GS-3;

Employment , Government Policies and Interventions

Focus:

The concept of Universal Basic Income (UBI) has gained attention in India due to rising unemployment, automation, and growing income inequality. Debates are intensifying about whether UBI could provide a solution to these issues, especially given the challenges of jobless and job-loss growth.

Current Employment Challenges in India:

- Jobless Growth: India faces a situation where economic growth is not translating into job creation. Despite rising output and productivity, the employment generation is lagging.

- Youth Unemployment: The International Labour Organization (ILO) reports that 83% of the unemployed in India are youth, highlighting a significant challenge in creating job opportunities for young people.

- Impact of Automation and AI: Automation and artificial intelligence (AI) are reducing the number of traditional jobs, contributing to rising inequality and diminishing job growth.

What is Universal Basic Income (UBI)?

- Income Support Mechanism: Aimed at reaching all or most of the population regardless of earnings or employment status.

- Objective: Provides sufficient income to cover basic living costs and ensure financial security.

- Principles:

- Universal: Available to everyone.

- Unconditional: No requirements for eligibility.

- Periodic: Regular payments.

- Cash Payment: Direct monetary transfers.

- Individual: Given to each person separately.

- Periodic Cash Transfer: UBI provides regular, unconditional cash payments to every citizen.

- Universal Coverage: It is not targeted; everyone receives it regardless of socio-economic status.

- Cash, Not In-Kind: Payments are made in cash rather than providing goods or services.

- Unconditional: Eligibility does not depend on employment status or socio-economic position.

- Income Security: Aims to provide financial stability and reduce poverty across all demographics.

- Simplified Administration: Streamlines welfare by replacing various targeted programs with a single, universal payment.

Why Universal Basic Income (UBI)?

- Reduces Inequality: Provides security and dignity, helping to alleviate poverty.

- Compensates for Technology Impact: Offsets reduced wages and purchasing power due to automation.

- Targeted Benefits: Full benefits are for those with zero income; partial benefits for others through taxation.

- Government Spending Shift: Alters revenue allocation from subsidies and services to direct cash transfers.

- Economic Liberty: Allows individuals to choose their work and reduces poverty.

- Equitable Wealth Distribution: Only the poor receive full net benefits.

- Efficiency and Inclusion: Simplifies implementation, reduces bureaucracy, promotes financial inclusion through JAM Trinity.

Potential Benefits of Universal Basic Income (UBI):

- Short-Term Relief: Addresses farm distress, stagnant rural wages, rising household debt, and weak consumer demand among the poor.

- Financial Viability: Providing UBI to the poorest 40 million households would cost approximately ₹4 trillion (1.2% of GDP), making it financially feasible.

- Direct Support: Highlights the necessity of direct support, as evidenced by government COVID food handouts.

Limitations of Universal Basic Income:

Inadequate Alone: UBI cannot end poverty without access to essentials like law and order, clean water, healthcare, and education.

Existing Forms of Income Support:

- Semi-UBI Models: India has implemented various income support schemes like cash transfers for farmers and women, and for unemployed youth in some states. These can be seen as forms of semi-UBI rather than a pure Universal Basic Income.

- Differences from True UBI: Unlike UBI, which provides income regardless of employment status, India’s current schemes are targeted and may not address the needs of all unemployed individuals uniformly.

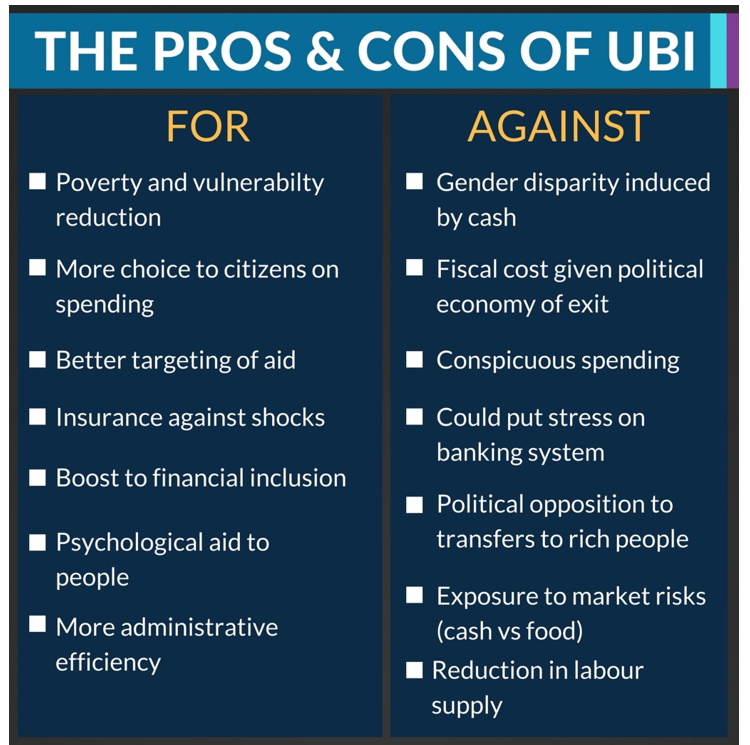

Arguments for and Against UBI

- Proponents’ View: Advocates argue that UBI could address market demand issues by providing financial support to those without employment, thus stimulating economic growth and reducing inequality.

- Criticism of UBI: Critics, like Professor Arun Kumar, argue that giving money without requiring work could lead to societal issues such as decreased dignity and increased alienation. They emphasise the need for generating employment through work rather than direct financial support.

Role of Government and Private Sector:

- Current Government Efforts: The Indian government has increased capital investment, but much of it is directed toward capital-intensive sectors, which do not generate substantial employment. Cuts in labour-intensive sectors like education and health have been noted.

- Need for Employment Generation: There is a call for more focus on labour-intensive sectors and social safety nets. Investments in infrastructure projects like railways and highways are seen as less effective in creating direct employment compared to past construction projects.

Impact of Technological Advances

- Automation and Job Loss:

- Technological advancements, including automation and AI, are transforming industries such as banking and trade, leading to fewer job opportunities.

- This shift has increased self-employment at lower income levels.

- Mismatch of Skills: There is a growing mismatch between the skills required for new jobs and those possessed by the workforce, exacerbating unemployment and underemployment issues.

Future Directions and Policy Recommendations:

- Focus on Social Safety Nets:

- Both Professors agree on the need for better universal social safety nets rather than a full UBI.

- The current safety nets are unevenly distributed and need improvement.

- Potential for Increased Direct Taxes:

- To fund more comprehensive social safety measures or a UBI, increasing the direct tax-to-GDP ratio could be considered.

- This requires political will and strategic planning to balance economic growth with equitable income distribution.

Challenges in Implementing Universal Basic Income (UBI) in India:

- Fiscal Constraints: India’s limited fiscal resources may make it difficult to implement UBI at a large scale without compromising other essential public services.

- Targeting Issues: Universal coverage could lead to inefficiencies, as wealthier individuals would also receive UBI, wasting resources meant for the poor.

- Employment Generation: Critics argue that UBI could disincentivize work, reducing labour participation and increasing dependency on the state.

- Social Stigma: Providing income without work may lead to societal alienation, with recipients labelled as unproductive, potentially deepening societal divisions.

- Inflationary Risks: A sudden increase in disposable income across the population could lead to inflation, negating the benefits of UBI for low-income households.

- Existing Social Schemes Overlap: Implementing UBI might lead to the elimination or reduction of current targeted welfare schemes, impacting specific vulnerable groups.

- Automation and AI Displacement: Rapid technological changes continue to displace jobs, requiring long-term structural adjustments, not just income support.

Way Forward:

- Phased Implementation: Start with targeted groups like farmers and unemployed youth before expanding coverage.

- Skill Development: Focus on education and vocational training to reduce skill mismatches in the job market.

- Employment Generation: Prioritise labour-intensive sectors like health, education, and rural development to create jobs.

- Strengthen Social Safety Nets: Improve and universalize existing welfare schemes to ensure coverage for the most vulnerable.

- Progressive Taxation: Increase direct taxes to fund UBI without compromising other essential services.

- Pilot Programs: Test UBI through small-scale pilots to assess feasibility and impact before nationwide rollout.

- Public-Private Collaboration: Encourage private sector investment in labour-intensive industries to complement government efforts in job creation.

Conclusion:

While UBI presents an opportunity to address income inequality and unemployment, its implementation in India requires careful consideration of fiscal capacity, inflation risks, and societal impacts. Strengthening existing social safety nets and focusing on employment generation may offer more viable solutions in the short term.

Source: The Hindu

Mains Practice Question:

Q: Discuss the feasibility of implementing Universal Basic Income (UBI) in India, considering the country’s economic, social, and political challenges. How can UBI address unemployment and inequality while ensuring sustainable economic growth?