INVESTMENT LESSONS FROM THE INDIA-EFTA TRADE DEAL

Syllabus:

GS 2:

Government Policies and Interventions for Development in various sectors

GS 3:

Indian Economy and issues relating to Planning, Mobilization of Resources, Growth, Development and Employment.

Focus:

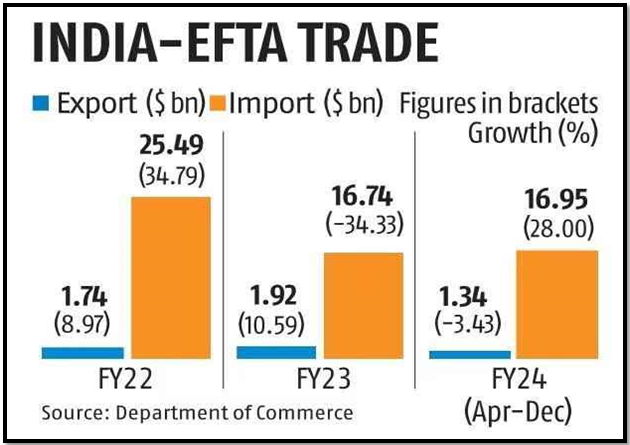

- The recent trade agreement between India and the European Free Trade Association (EFTA) marks a significant milestone in India’s trade relations.

- While negotiations with other countries like the UK and EU are on hold due to elections, India successfully concluded an FTA with EFTA.

Source: DCMF

Overview:

- The agreement aims to bolster trade between India and EFTA member countries, including Iceland, Liechtenstein, Norway, and Switzerland.

- Notably, the inclusion of provisions related to investment sets this FTA apart from recent agreements signed by India.

- The investment chapter in the India-EFTA FTA focuses on investment facilitation, signaling a departure from traditional investment protection clauses.

Unprecedented Investment Provisions:

- The India-EFTA FTA includes ground-breaking investment provisions, aiming to enhance foreign direct investment (FDI) and job creation in India.

- EFTA countries commit to striving for $100 billion in FDI within ten years of the FTA’s implementation, followed by another $50 billion in the subsequent five years.

- Additionally, the agreement targets the generation of one million jobs in India, demonstrating a unique approach towards fostering economic growth.

- These provisions introduce obligations of conduct, wherein EFTA countries are obligated to make sincere efforts to achieve the specified targets.

- The incorporation of such ambitious goals in the investment chapter reflects India’s proactive stance in attracting foreign investment and promoting job creation.

Interlinkage of Trade and Investment:

- Economic theory highlights the symbiotic relationship between trade and investment, especially in the context of global supply chains.

- Traditionally, FTAs encompass rules governing both trade and investment to facilitate seamless economic integration.

- India’s early FTAs with countries like Japan and Korea exemplified this approach by including investment protection clauses alongside trade agreements.

- However, recent FTAs pursued by India, such as those with Australia and the UAE, have focused primarily on trade, side-lining investment provisions.

- The India-EFTA FTA marks a departure from this trend by reintegrating investment considerations into the trade agreement, recognizing their interconnectedness.

India’s FTA Approach:

- India’s FTA 2.0 strategy, characterized by separate agreements on trade and investment, represented a departure from traditional FTA models.

- Recent FTAs signed by India with countries like Australia, Mauritius, and the UAE followed this decoupling approach, emphasizing trade over investment.

- However, the India-EFTA FTA deviates from this pattern by reintegrating investment provisions into the trade agreement.

- This shift in strategy suggests a potential reevaluation of India’s FTA approach, emphasizing the importance of investment facilitation alongside trade promotion.

- The decision to include investment provisions in the India-EFTA FTA underscores India’s recognition of the critical role of investment in driving economic growth and development.

| Highlights of the Agreement

Investment Commitments:

Tariff Offerings:

Market Access:

Sectorial Commitments:

Professional Services Recognition:

|

FTA 3.0 Policy Recommendations:

- India requires a coherent FTA policy that integrates trade and investment negotiations into a single comprehensive framework.

- Combining trade and investment discussions enhances India’s bargaining power and enables the negotiation of mutually beneficial agreements.

- A clear and comprehensive FTA policy would provide direction to India’s trade and investment strategies and strengthen its position in the global economy.

- Furthermore, India should prioritize the expansion of investment protection provisions within FTAs to safeguard the interests of foreign investors.

- By enhancing legal safeguards for foreign investors and promoting a conducive investment climate, India can attract higher levels of FDI and stimulate economic growth.

Towards Sustainable Economic Growth:

- The India-EFTA trade deal serves as a catalyst for sustainable economic growth by fostering stronger trade and investment ties between India and EFTA countries.

- A coherent FTA policy, integrating trade and investment considerations, is essential for unlocking new avenues for economic development.

- By adopting a holistic approach to trade and investment negotiations, India can leverage its strengths and opportunities to drive sustainable economic growth.

- The inclusion of ambitious investment provisions in the India-EFTA FTA reflects India’s commitment to attracting foreign investment and promoting job creation.

- Moving forward, India must continue to pursue proactive policies that facilitate trade and investment, positioning itself as a preferred destination for global investors.

Challenges:

- Implementation Hurdles: Despite ambitious targets, achieving $100 billion in FDI and creating one million jobs within the stipulated timeframe poses significant implementation challenges.

- Monitoring and Compliance: Ensuring that EFTA countries fulfill their commitments to increase FDI and job creation requires robust monitoring mechanisms and enforcement measures.

- Economic Uncertainty: Economic fluctuations and geopolitical tensions could impact investor confidence and hinder the flow of foreign investment into India.

- Policy Coordination: Coordinating policies across sectors to create an enabling environment for investment and job creation demands effective inter-ministerial collaboration and regulatory alignment.

- Infrastructure Deficits: Inadequate infrastructure and logistical challenges could impede the realization of investment targets, necessitating substantial investments in infrastructure development.

Way Forward:

- Enhanced Collaboration: Strengthening partnerships with EFTA countries through regular consultations and joint initiatives can foster mutual understanding and facilitate the achievement of investment targets.

- Policy Reforms: Implementing structural reforms to improve the ease of doing business, streamline regulatory processes, and enhance transparency can attract greater foreign investment and promote job creation.

- Investment Promotion: Launching targeted investment promotion campaigns and roadshows to showcase India’s investment opportunities and incentivize foreign investors can stimulate FDI inflows.

- Capacity Building: Investing in skill development and vocational training programs to enhance the employability of the workforce can support job creation efforts and ensure inclusive growth.

- Infrastructure Development: Prioritizing infrastructure projects and mobilizing resources for their timely execution can address infrastructure deficits and create an enabling environment for investment.

- Policy Stability: Providing policy certainty and predictability through stable regulatory frameworks and consistent policy measures can instill confidence in investors and attract long-term investments.

- Global Engagement: Actively engaging with international organizations and multilateral forums to promote investment cooperation and share best practices can leverage global expertise and resources for India’s development agenda.

Conclusion:

The India-EFTA trade deal exemplifies the importance of integrating investment considerations into FTAs and underscores the need for a coherent FTA policy to drive sustainable economic growth. By prioritizing investment facilitation alongside trade promotion, India can unlock new opportunities for economic development and strengthen its position in the global economy.

Source:The Hindu

Mains Practice Question:

Discuss the significance of the India-EFTA trade deal in the context of India’s evolving FTA strategy, focusing on the integration of investment provisions within the trade agreement and its implications for future FTAs.

Associated Article: