INTERIM BUDGET 2024 ANALYSIS

Syllabus:

- GS 3 : Government Budgeting

Why in the News ?

- The Interim Budget for 2024-25 was presented with a focus on electoral campaigning, evident from Prime Minister Modi’s statement regarding the timing of presenting the budget.

- An interim Economic Survey titled “The Indian Economy: Review” provided a retrospective analysis of economic development, highlighting the decade 2014-24 as a period of “transformative growth.”

Source: Transforming India

Eulogy of Government:

- The interim budget reverberated with praises for the last two governments, reflecting a political narrative.

- Budget speeches often reiterate existing policies rather than focusing on resource mobilization or allocation strategies, diverting from the actual concern.

What is Interim Budget ?

- An interim budget is a financial plan presented by a government during a transition period.

- Typically prepared when a new government is expected, ensuring financial continuity.

When is an Interim Budget Presented?

- During transitions between two governments or in an election year.

- When the government dissolves, awaiting the formation of a new one.

- When a new government needs time for a comprehensive budget.

- To sustain essential services until a regular budget is prepared.

- Addressing immediate needs amid significant economic or political changes.

| Understanding the Budget

The Union Budget is India’s annual financial statement presented on February 1st by the Finance Minister in the Lok Sabha. Budget Preparation: The Department of Economic Affairs, Ministry of Finance, prepares the Budget document. Budget Classification: · Revenue Budget: Covers expected income and expenses within a year, including taxes and regular sources of revenue. · Capital Budget: Manages government assets and liabilities, including major expenses like infrastructure development. Budget Parts: · Part A: Announces government schemes, priorities, and sector allocations. · Part B: Contains the Finance Bill, including taxation proposals like income tax revisions and indirect taxes. The Finance Bill is considered a Money Bill under Article 110 of the Constitution, subject to the Speaker’s approval. Constitutional Provisions Related to India’s Union Budget: · As per Article 112, the Union Budget is the government’s estimated receipts and expenditures, termed the Annual Financial Statement. · Key Budget documents include the Annual Financial Statement, Demands for Grants, Finance Bill, and Fiscal Policy Statements mandated by the Fiscal Responsibilty and Budget Management Act (FRBM Act), 2003. · Additional explanatory documents presented include Expenditure & Receipt of Budget, Expenditure Profile, Budget at a Glance, and more. Objectives of Union Budget: · Economic Growth: Stimulate rapid and balanced economic growth nationwide. · Social Justice and Equality: Promote social justice and equality, ensuring equitable distribution of benefits. · Resource Allocation: Allocate resources effectively to minimize unemployment and poverty. · Fiscal Stability: Maintain fiscal stability by controlling prices, reducing wealth and income disparities, and reforming the tax system. |

Fiscal Performance and Deviations:

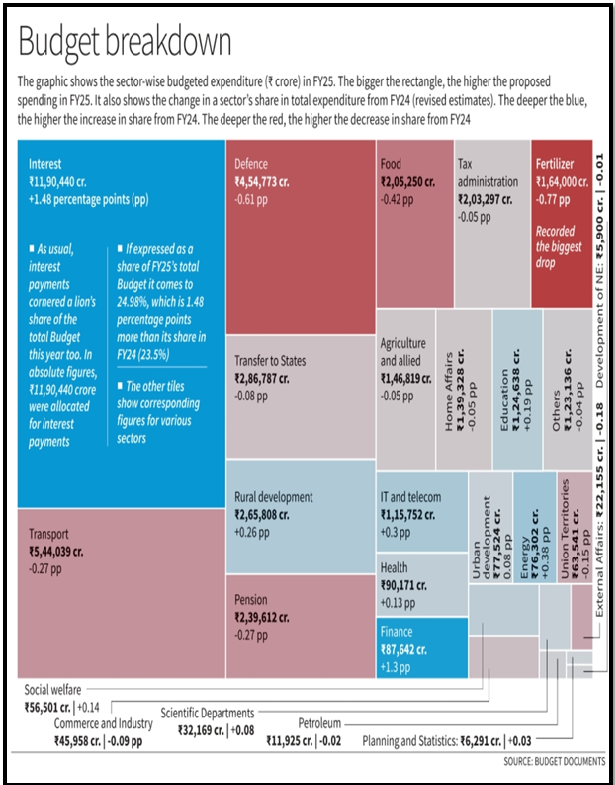

- Examining fiscal performance for 2023-24 reveals discrepancies between budgeted and actual expenditures.

- Notably, allocations for schemes like MGNREGA and PM-KISAN show significant deviations, suggesting potential political motivations.

- Despite claims of pro-poor initiatives, actual allocations often fall short, raising questions about the government’s commitment.

Source: TH

Macroeconomic Trends and Fiscal Management:

- The Budget claims to align receipts with projections, with tax and non-tax revenues meeting expectations.

- However, significant variations in dividends and disinvestment proceeds raise doubts about fiscal prudence.

- Despite efforts to maintain a fiscal deficit at 5.8% of GDP, the real impact on voters remains uncertain amidst election fervour.

Positives in the Budget:

- The Budget highlighted the revival of post-COVID growth attributed to public infrastructure investments.

- It proposed a moderate increase in public investment, aiming to complement the private sector resurgence.

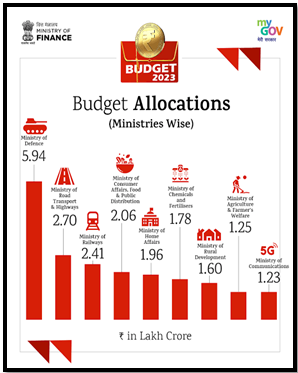

- Previous investments in infrastructure, particularly in highways and communications, contributed to GDP growth.

- Amidst global energy supply uncertainties, increased investments in energy security were noted, deviating from disinvestment agendas.

Ignored Agricultural Distress:

- Despite claims of agricultural growth, the Budget fails to address the sector’s distress, evident in stagnant incomes and rising unemployment.

- MSP inadequacies and stagnant real wages contribute to rural economic woes, with public investment in agriculture remaining stagnant.

- The Budget lacks substantive measures to reverse the decline in agricultural growth or alleviate rural distress, despite rhetoric on blue revolution and fisheries sector focus.

Neglect of Social Sector:

- Allocations for social sector schemes remained stagnant or saw nominal increases, failing to address the persistent issue of inadequate funding for crucial sectors like education, health, and nutrition.

- Continued neglect of the social sector exacerbates inequalities and fails to address the looming job crisis, hindering long-term national development.

Concerns and Misleading Claims:

- While FDI inflow was touted as doubling from 2014-23, the actual impact on fixed investment growth remains modest.

- The Budget’s political message painted a rosy picture of economic growth, overlooking critical concerns like employment stagnation.

- Despite claims of poverty alleviation and income growth, disparities persist, with rural wages stagnating and real incomes declining.

- The Budget’s focus on visible schemes sidelines crucial sectors like education, health, and social security, exacerbating inequalities.

The interim Budget for 2024-25, while acknowledging achievements, falls short in addressing critical economic concerns.

Political messaging overshadowed substantive policy measures, neglecting issues like employment stagnation and agricultural distress.

Without concrete steps to address existing shortcomings, the Budget’s optimistic tone may ring hollow for those experiencing economic hardships.

Source:

https://www.thehindu.com/opinion/op-ed/a-case-of-capex-under-the-macroscope/article67801737.ece/amp/

Mains Practice Question:

Assess the effectiveness of the budget in addressing key socio-economic concerns. Evaluate the government’s fiscal management strategies and their implications for long-term national development.

Source: Transforming India

Source: Transforming India Source: TH

Source: TH