INTERGENERATIONAL EQUITY AS TAX DEVOLUTION CRITERION

Relevance: GS 2 – Functions and responsibilities of the Union and the States, issues and challenges pertaining to the federal structure, devolution of powers and finances up to local levels and challenges therein.

Why in the News?

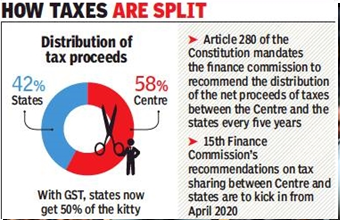

- A key point in this discussion is the horizontal distribution of States’ share in Union tax revenue.

- The Finance Commission (FC) revisits and decides the horizontal distribution formula every five years.

- The distribution formula predictably prioritizes equity over efficiency.

- Equity in this context refers to intragenerational equity, which aims to redistribute tax revenue among States.

- However, this focus on equity can lead to increased intergenerational inequity within States.

- The Finance Commission should reconsider the criteria used to incentivize fiscal efficiency among states.

Intergenerational Fiscal Equity

- Intergenerational equity ensures equal opportunities and outcomes across generations, avoiding burdening future generations with current decisions or actions.

- From a public finance perspective, intergenerational equity refers to Ensuring each generation pays for the public services it utilizes without imposing financial burdens on future generations through borrowing.

- Revenue Generation:

- Governments raise revenue through taxation or borrowing.

- If tax revenue equals current expenditure, current taxpayers pay for current public services received.

- Borrowing for current expenditure shifts the burden to future generations, constituting intergenerational inequity.

- Ricardian Equivalence Theory:

- When governments borrow to finance current expenditure, households react by increasing savings.

- This increased savings is believed to prepare future generations to pay higher taxes, thereby maintaining consistent aggregate demand in the economy over time.

- The theory assumes that the current generation pays taxes that are less than the value of the current public services it receives, prompting households to save in anticipation of future tax liabilities.

- When governments borrow to finance current expenditure, households react by increasing savings.

Federal Fiscal Dynamics in India:

- State Categorization: High-income States (Tamil Nadu, Kerala, Karnataka, Maharashtra, Gujarat, Haryana) versus low-income States (Bihar, Uttar Pradesh, Madhya Pradesh, Rajasthan, Odisha, Jharkhand) during the 14th Finance Commission period (2015-20).

- Developed states may face higher taxes not entirely used within their boundaries, leading to increased borrowing or reduced expenditure.

- Developing states may have lower taxes relative to current expenditure, relying on higher financial transfers from the Union government to bridge gaps.

- Revenue and Expenditure Analysis:

- High-income States financed 3% of their revenue expenditure through own tax revenues, whereas low-income States financed only 35.9%.

- Revenue Expenditure to Gross State Domestic Product (GSDP) ratio was 9% for high-income States and 18.3% for low-income States, indicating higher spending relative to their economic output in low-income States.

- Union Financial Transfers:

- Low-income States relied significantly on Union financial transfers, with 7% of their revenue expenditure financed this way, compared to 27.6% for high-income States.

- Deficits and Financial Management:

- Despite higher own tax revenues and lower revenue expenditure, high-income States incurred a deficit of 13.1%, while low-income States had a deficit of 6.4%.

- This disparity was partly due to lower Union financial transfers to high-income States.

- Equity in Service Provision:

- Citizens expect equitable access to public services based on the taxes they pay, both direct and indirect.

- Federal and State governments must align service provision with tax contributions to avoid inequities.

- Balancing Equity:

- Balancing intragenerational equity across States ensures a unified market and fair distribution of resources within a federal framework.

- The distribution formula for tax devolution by the Finance Commission plays a crucial role in maintaining this balance, addressing conflicting equity issues between high-income and low-income States.

Current Distribution Criteria and Issues

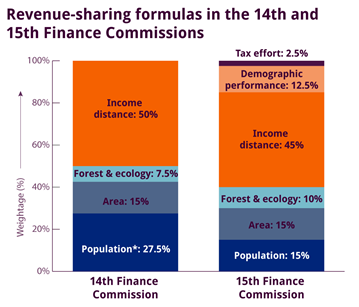

- Indicators Used: Finance Commissions (FCs) typically use indicators like per capita income, population, and area to distribute Union financial transfers.

- These indicators aim to balance the demand for public services and the revenue potential across States.

- Limitations of Proxy Variables:

- While these indicators are important, they may not fully capture the actual fiscal situations of States, such as their tax efforts and fiscal discipline.

- Efficiency indicators, derived from State budgets, provide insights into fiscal behaviors influenced by Union financial transfers.

Way forward to Fiscal Equity

- Include Fiscal Variables: There is a proposal to increase the weighting of fiscal variables in the distribution formula. These variables would better reflect States’ fiscal capabilities and behaviors influenced by Union financial transfers.

- This approach aims to incentivize States towards greater fiscal discipline, efficient expenditure management, and increased tax efforts.

- Impact on Fiscal Behavior: Union financial transfers significantly impact State budgets, influencing their fiscal behavior and adherence to fiscal responsibility acts.

- Adjusting the weightage towards fiscal indicators can encourage States to manage deficits and public debt more sustainably, aligning with intergenerational fiscal equity goals.

- Ensuring Sustainable Debt Management:

- By assigning greater weight to fiscal indicators, FCs can effectively promote sustainable debt management practices among States.

- This approach helps mitigate the risk of States breaching legal fiscal limits due to inadequate Union financial transfers.

- Align with State Fiscal Laws: Ensure that distribution criteria encourage States to comply with their Fiscal Responsibility and Budget Management Acts, preventing excessive deficits and debt accumulation.

- Promote Transparency and Accountability: Implement mechanisms to track and report on the utilization of Union financial transfers, ensuring they are used effectively for public services.

- Regular Review and Adjustment: Periodically review and adjust the distribution formula to reflect changing economic and fiscal conditions, promoting fairness and equity among States.

- Capacity Building: Support States in improving their fiscal management capabilities through training and technical assistance, enhancing their ability to utilize resources efficiently.

Alternative articles:

Mains question

Discuss the role of fiscal equity in India’s federal system. Evaluate the effectiveness of current Finance Commission criteria and propose reforms to ensure intergenerational equity and fiscal discipline among states. (250 words)