Insolvency and Bankruptcy Code

Context: The Insolvency and Bankruptcy Code (IBC) Amendment Bill is likely to be tabled in the Monsoon session which will pave the way for resolution of group insolvency, enabling lenders to take subsidiary companies to NCLT as a combined entity. The government is working towards group insolvency. It will be part of the Insolvency and Bankruptcy Code Amendment Bill.

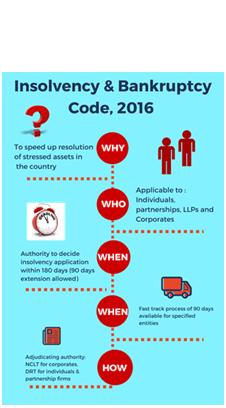

What is the IBC?

- When a company or business turns insolvent or sick, it begins to default on its loans. In order for credit to not get stuck in the system or turn into bad loans, it is important that banks or creditors are able to recover as much as possible from the defaulter, as quickly as they can.

- In 2016, at a time when India’s Non-Performing Assets and debt defaults were piling up, and older loan recovery mechanisms such as SARFAESI Act 2002 were performing badly.

- IBC was introduced to overhaul the corporate distress resolution regime in India and consolidate previously available laws to create a time-bound mechanism with a creditor-in-control model as opposed to the debtor-in-possession system.

- When insolvency is triggered under the IBC, there can be just two outcomes: resolution or liquidation.

Objectives

- The first objective of the IBC is resolution — finding a way to save a business through restructuring, change in ownership, mergers etc.

- The second objective is to maximize the value of assets of the corporate debtor.

- The third is to promote entrepreneurship, availability of credit, and balancing of interests.

What are the challenges for the IBC?

- According to IBBI data for the 3,400 cases admitted under the IBC in the last six years, more than 50% of the cases ended in liquidation, and only 14% could find a proper resolution.

- Furthermore, the IBC was touted as a time-bound mechanism. However, in FY22, it took 772 days to resolve cases involving companies that owed more than ₹1,000 crore.

- The Parliamentary Standing Committee on Finance pointed out in 2021, that in the five years of the IBC, creditors on an average had to bear an 80% haircut in more than 70% of the cases.

- As per the data close to 33 of 85 companies so far that owed more than ₹1,000 crore, lenders had to take above 90% haircuts.

Way Forward

In order to address the delays, the Parliamentary Standing Committee suggested that the time taken to admit the insolvency application and transfer control of the company to a resolution process, should not be more than 30 days after filing.

The IBBI has also called for a new yardstick to measure haircuts. It suggested that haircuts not be looked at as the difference between the creditor’s claims and the actual amount realized but as the difference between what the company brings along when it enters IBC and the value realized.

| Practice Question

1. What is the Insolvency and Bankruptcy Code ? What are the challenges for the IBC?

|