India’s Sugar Success Story

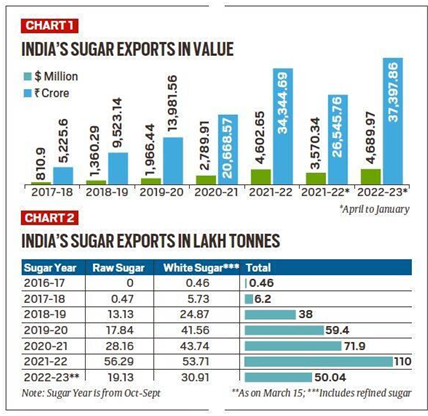

Context: Between 2017-18 and 2021-22, India’s Sugar export soared from $810.9 million to $4.6 billion, and could cross $5.5 billion — or Rs 45,000 crore — in the fiscal year ending March 31.

Raw and White Sugar

- Raw sugar is what mills produce after the first crystallisation of juice obtained from crushing of cane.

- This sugar is rough and brownish in colour, with an ICUMSA value of 600-1,200 or higher.

- ICUMSA(International Commission for Uniform Methods of Sugar Analysis) is a measure of the purity of sugar based on colour. The lower the value, the more the whiteness.

- Raw sugar is processed in refineries for removal of impurities and de-colourisation.

- The end product is refined white cane sugar having a standard ICUMSA value of 45.

- The sugar used by industries such as pharmaceuticals has ICUMSA of less than 20.

What changed after 2017

- Till 2017-18, India hardly exported any raw sugar. It mainly shipped plantation white sugar with 100-150 ICUMSA value. This was referred to as low-quality whites or LQW in international markets.

- Around mid-2018, a team of officials visited Indonesia, Malaysia, South Korea, China and Bangladesh to promote exports of raw sugar from India.

- Much of the world sugar trade is in ‘raws’ that are transported in bulk vessels of 40,000-70,000 tonnes capacity.

- ‘Whites’, on the other hand, are usually packed in 50-kg polypropylene bags and shipped in 12,500-27,000-tonne container cargoes over shorter distances.

- Raw sugar requires no bagging or containerisation and can be loaded in bulk; the buyer here is the refiner, not the end-consumer.

- The refineries in those countries mostly imported raws from Brazil.

- Brazilian mills operate from April to November, whereas our crushing is from October to April.

- Indian officials told them that they could source our raws during Brazil’s off-season.

- The voyage time from Kandla, Mundra or JNPT to Ciwandan Port of Indonesia is 13-15 days, compared to 43-45 days from Brazil’s Port of Santos.

India’s raw advantage

- Apart from the time window and freight cost savings, the delegation highlighted two specific advantages of Indian raw sugar.

- First, it is free of dextran, a bacterial compound formed when sugarcane stays in the sun for too long after harvesting. “Our raw sugar has no dextran, as it is produced from fresh cane crushed within 12-24 hours of harvesting. The cut-to-crush time is 48 hours or more in Brazil.

- Second, Indian mills could supply raws with a very high polarisation of 98.5-99.5%. Polarisation is the percentage of sucrose present in a raw sugar mass. The more the polarisation — it is only 96-98.5% in raws from Brazil, Thailand and Australia — the easier and cheaper it is to refine.

- The efforts to push exports of raws got a further boost when Indonesia, in December 2019, agreed to tweak its ICUMSA norms to enable imports from India.

- The Southeast Asian nation previously imported only raw sugar of 1,200 ICUMSA or more, largely from Thailand. Those levels were brought down to 600-1,200 to allow its refiners to process higher purity raws from India.

The end result

- Out of India’s total 110 lt sugar exports in 2021-22, raws alone accounted for 56.29 lt.

- The biggest importers of Indian raw sugar were Indonesia (16.73 lt), Bangladesh (12.10 lt), Saudi Arabia (6.83 lt), Iraq (4.78 lt) and Malaysia (4.15 lt).

- The country also exported 53.71 lt of white/ refined sugar, the leading destinations for which included Afghanistan (7.54 lt), Somalia (5.17 lt), Djibouti (4.90 lt), Sri Lanka (4.27 lt), China (2.58 lt), and Sudan (1.08 lt).

- From being a marginal exporter until five years ago, India has become the world’s No. 2, with its shipments of 110.58 lt in 2021-22 (according to the International Sugar Organization) next only to Brazil (255.40 lt) and way ahead of Thailand (79.86 lt) and Australia (25.67 lt).

| Practice Question

1. India’s Sugar Industry has seen an exponential growth in the export sector. What are the reasons for it’s rise? |