INDIA’S GROWTH SURPRISE

Relevance: GS 3 – Indian Economy and issues relating to Planning, Mobilization of Resources, Growth, Development and Employment.

Why in the News?

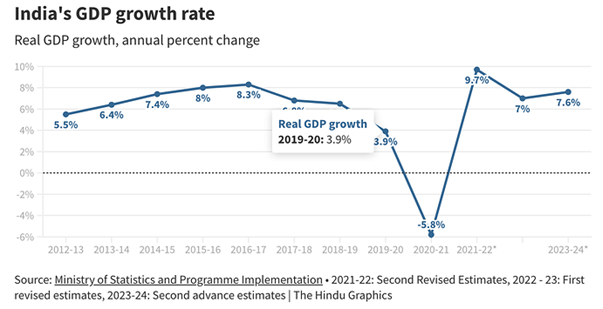

- India’s GDP growth for the third quarter has exceeded expectations, reaching 6% according to the National Statistical Office’s second advance estimate.

- The initial estimate on January 5 projected GDP growth at 7.3%, indicating an upward revision.

- Additional data for two months has contributed to this growth, suggesting a strengthening economic momentum in the third quarter.

- Growth in gross value added, excluding the net tax impact, stood at 9%, indicating a slightly lower rate compared to the overall GDP growth.

Current Growth Scenario

- The full fiscal year’s growth projection stands at 7.6%, with the first three quarters averaging 8.2% growth.

- The implicit fourth-quarter growth is estimated at 5.9%, reflecting a slight moderation.

- Despite the pandemic’s impact, domestic strengths and policy measures have propelled the economy towards a 7% growth trajectory.

FACTORS INFLUENCING GROWTH

Strengthened bank and corporate balance sheets, along with government focus on infrastructure, have bolstered growth performance.

- The RBI’s latest monetary policy statement forecasted India’s GDP growth at 7% for the upcoming year.

- Growth is anticipated to moderate next year due to high interest rates and a lower fiscal impulse, with the fiscal deficit targeted to reduce to 5.1% of GDP.

- Monetary policy’s influence on economic growth is limited due to projected inflation levels staying above the RBI’s 4% target.

- Importance of Data Releases:

- The second advance estimates provide insights into GDP growth for the current year, although the provisional estimates in May are expected to offer a more accurate and long-lasting projection.

- Consumption Trends:

- Other accompanying data, such as details on private consumption, savings, and investment for 2022-23, add to the significance of the release.

- Private consumption growth at 3% has lagged behind overall GDP growth.

- Rural consumption likely trailed urban consumption due to higher food inflation impacting discretionary spending power, particularly with minimal growth in agriculture.

- Nominal food consumption spending saw a significant increase last year, likely continuing this trend, with certain sectors experiencing better performance for higher-ticket items compared to entry-level ones.

Trends in Consumption Expenditure

- Recent household consumption expenditure data indicates a shift towards non-food items over time, typically seen with rising per capita income.

- Even within food consumption, there’s a noticeable move from cereals towards processed items.

- This shift in consumption patterns could prompt adjustments in the weightages of the consumer price index basket, which currently reflects 2011-12 consumption patterns.

National Savings Dynamics

- The split of national savings among the government, households, and the private sector is a crucial data point.

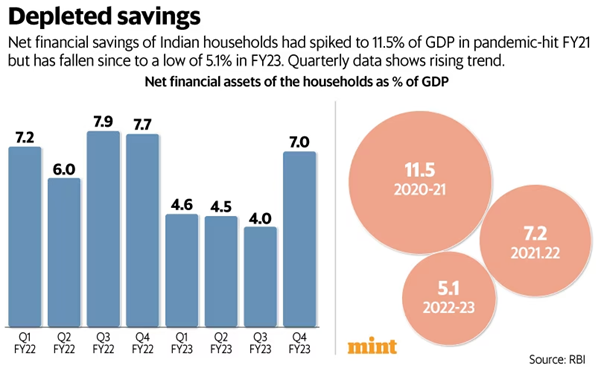

- Despite remaining around 30% for 2022-23, the overall savings rate (savings/GDP) is below its decadal peak.

- Corporate savings represent 2% of GDP.

- Household Savings are divided into financial and physical savings.

- Household savings constitute the largest portion (61%) of total savings, with its share in GDP dropping to 4% in 2022-23.

- Financial savings data from the RBI, reported by NSO, indicates a notable decline in net financial savings of households, decreasing to 5.3% of GDP in 2022-23 from 7.3% in 2021-22.

- Net financial savings are calculated as the difference between gross savings and household borrowings/liabilities.

- While net financial savings as a percentage of GDP declined, there was a simultaneous increase in physical savings.

- Households seemingly utilized borrowings to acquire physical assets such as houses, consequently boosting physical savings.

Impact on Housing Demand

- Strong housing demand is evident, likely driven by increased retail borrowings amid robust asset demand.

- Consumers, especially younger demographics, are displaying a greater willingness to take on debt.

Shifts in Savings Dynamics

- Traditionally, savings in physical assets have outweighed those in financial assets.

- Financial inclusion initiatives have boosted the financial savings rate, narrowing the gap between financial and physical savings.

- However, during the pandemic, there was a notable increase in the financial savings rate while physical savings declined.

- In 2020-21, net financial savings briefly surpassed physical savings, but this trend corrected post-pandemic recovery.

- Household savings in physical assets have once again exceeded net financial savings, reaching a decadal low in 2022-23.

Disaggregated Investment Data

- NSO’s release includes comprehensive data on private corporate investments, alongside public and household investments for 2022-23.

- Public and household investments experienced faster growth in fiscal 2022-23, while private corporate investment stagnated.

- Similar trends are anticipated in the current fiscal, with government and household investments showing relative strength compared to private corporate investment.

SUSTAINING THE GROWTH FOR FUTURE

- Corporate Investment

- Current fiscal shows signs of a resurgence in corporate investments, particularly driven by the Production-Linked Incentive (PLI) scheme.

- Investments, especially in pharmaceuticals and electronics, have been notable under the PLI scheme.

- Rising investments in steel and cement are directly linked to government-led infrastructure and housing revival efforts.

- Investment Shifts

- Higher capacity utilization levels in the manufacturing sector are expected to translate into increased capital expenditure (capex).

- Transition from assembly-type operations to core/capital-intensive segments like advanced chemistry cell batteries and electric vehicles is foreseen under the PLI scheme.

- Healthy corporate balance sheets enhance the corporate sector’s capacity to leverage and undertake investments.

- A broad-based revival of private investments is deemed crucial for sustaining high growth rates in the medium term, especially as government investments moderate to facilitate fiscal consolidation.

- Policy Recommendations

- Reduction in policy uncertainty and compliance costs could provide an additional boost to corporate investments.

- Addressing these concerns would be a significant expectation from the next government, potentially providing further impetus to private sector investment.

Source: https://indianexpress.com/article/opinion/columns/dk-joshi-writes-indias-growth-surprise-9191094/

Mains question

Discuss the dynamics of India’s economic growth, focusing on shifts in savings patterns and the role of government policies. Evaluate challenges and recommendations for sustaining growth. (250 words)