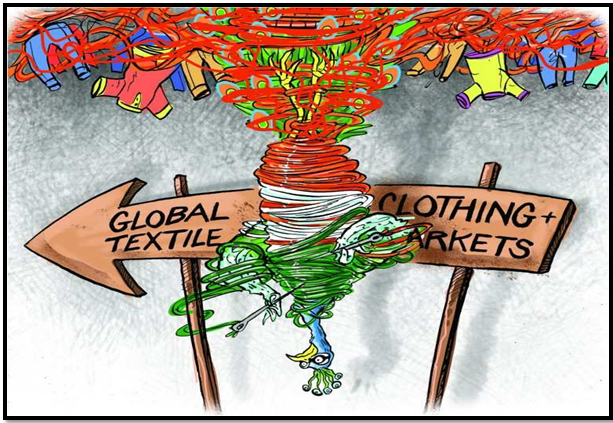

INDIA’S GARMENT EXPORT WOES SELF-INFLICTED

Source: static.toiimg.com

Relevance:

GS 3 –

Indian Economy and issues relating to Planning, Mobilization of Resources, Growth, Development, and Employment.

Focus

- The garment export sector in India, a significant contributor to employment and GDP, is experiencing a downturn.

- This analysis examines the factors contributing to the decline, the importance of the sector, the major markets, and competition from countries like Bangladesh and Vietnam.

- It also discusses government measures to address these challenges.

Current Scenario

India’s garment exports in 2023-24 were $14.5 billion, a decline from $15 billion in 2013-14. Despite the sector’s potential, high duties, barriers on raw material imports, and cumbersome customs and trade procedures have hindered its growth.

- Export Value: The export value has decreased over the past decade, highlighting the need for reforms and support.

- Job Creation: The garment sector is labor-intensive, providing employment to millions, particularly women, in rural and semi-urban areas.

- GDP Contribution: The sector significantly contributes to India’s GDP, making its growth crucial for economic development.

Challenges Faced

- High Duties and Barriers: High import duties and barriers on essential raw materials like polyester staple fiber and viscose staple fiber have increased production costs.

- Complex Procedures: Cumbersome customs and trade procedures delay the import of raw materials and export of finished goods, affecting competitiveness.

- Quality Control Orders: Recent quality control orders for fabric imports have complicated the process of sourcing raw materials, further pushing up costs for exporters.

- Technological Gaps: Lack of investment in modern technology and innovation hampers the productivity and quality of Indian garments compared to competitors.

- Domestic Interests: Domestic vested interests and restrictive policies impede the sector’s growth and adaptation to global market demands.

Major Competition

- Bangladesh: Between 2013 and 2023, Bangladesh’s garment exports grew nearly 70% to $43.8 billion, capitalizing on lower production costs and favorable trade policies.

- Vietnam: Garment exports from Vietnam have grown by 82% to $33.4 billion, benefiting from strategic trade agreements and efficient supply chain management.

Government Measures

- Production-Linked Incentive (PLI) Scheme: Launched to boost domestic manufacturing and exports in the textile sector, but its effectiveness needs evaluation and improvement.

- Global Trade Research Initiative (GTRI): Recommendations for simplifying trade procedures, import restrictions, and enhancing domestic infrastructure are crucial for revitalizing the sector.

- Ease of Doing Business: Streamlining customs procedures, reducing bureaucratic hurdles, and ensuring timely clearances can significantly improve the business environment for garment exporters.

- Investment in Technology: Encouraging investment in modern manufacturing technologies and innovation to enhance productivity and quality.

- Skill Development: Implementing comprehensive skill development programs to train the workforce in modern techniques and ensure a steady supply of skilled labor.

- Infrastructure Development: Developing state-of-the-art infrastructure, including logistics, storage, and transportation, to support the garment export sector.

- Market Diversification: Exploring new markets and reducing dependence on traditional markets to mitigate risks associated with global economic fluctuations.

Importance of the Garment Sector

- Employment Generation: The sector is a major source of employment, especially for women, contributing to socio-economic development in rural and semi-urban areas.

- Economic Growth: A robust garment sector boosts overall economic growth through increased exports and higher GDP contribution.

- Foreign Exchange Earnings: The sector is a significant earner of foreign exchange, helping to balance India’s trade deficit.

- Rural Development: The sector plays a vital role in rural development by providing employment and promoting inclusive growth.

Market Analysis

- Major Markets: The primary destinations for Indian garments are the United States, European Union, and the Middle East, which together constitute a substantial portion of India’s garment exports.

- Emerging Markets: Africa, Latin America, and Southeast Asia offer potential growth opportunities for expanding India’s garment export base.

Technological Adoption

- Automation: Implementing automation in manufacturing processes to boost efficiency and reduce production costs.

- Sustainable Practices: Adopting eco-friendly dyes and fabrics to align with global standards and consumer demand for sustainable products.

- Digital Platforms: Leveraging digital platforms for marketing, sales, and supply chain management to streamline operations and enhance market reach.

Competitiveness Strategies

- Cost Reduction: Reducing production costs by negotiating better raw material prices and optimizing supply chain operations.

- Quality Enhancement: Improving quality control measures and adhering to international standards to enhance product quality.

- Brand Building: Investing in brand building to establish a strong identity for Indian garments in the global market.

Policy Recommendations

- Integrated Policy Framework: Creating a comprehensive policy framework that addresses production, logistics, marketing, and export facilitation in the garment sector.

- Trade Agreements: Securing favorable trade agreements with key markets to improve market access and lower tariff barriers.

- Export Promotion: Strengthening export promotion councils and trade bodies to provide market intelligence, networking opportunities, and advocacy for garment exporters.

Environmental Dimensions

- Sustainable Production: Promoting the use of sustainable materials and processes to minimize the environmental impact of garment manufacturing.

- Waste Management: Implementing effective waste management practices to reduce waste and encourage recycling within the industry.

- Carbon Footprint: Decreasing the carbon footprint of garment production through energy-efficient technologies and renewable energy sources.

Social Dimensions

- Gender Equality: Ensuring equal pay, safe working conditions, and career advancement opportunities for women in the workplace.

- Worker Rights: Strengthening labor laws and regulations to protect garment workers’ rights, ensuring fair wages and safe working conditions.

- Community Development: Investing in community development programs to enhance the quality of life for workers and their families.

Global Comparisons

- China: China remains the leading garment exporter, benefiting from economies of scale, advanced technology, and efficient supply chains, though rising labor costs pose a challenge.

- Bangladesh: Bangladesh’s competitive advantage lies in low labor costs and favorable trade agreements, but it faces issues related to labor rights and factory safety.

- Vietnam: Vietnam excels with strategic trade agreements, efficient supply chains, and high-quality production, continuing to attract foreign investment in the textile sector.

Innovation and Research

- Research and Development: Investing in research and development to create new fabrics, enhance manufacturing processes, and develop sustainable practices.

- Industry-Academia Collaboration: Promoting collaboration between industry and academia to drive innovation and address industry challenges through research and training.

- Tech Hubs: Establishing tech hubs and innovation centers dedicated to the garment and textile industry to foster creativity and technological advancement.

Conclusion

Tackling the challenges in the garment export sector requires a multi-faceted approach, including policy reforms, technological investments, and improving the ease of doing business. By implementing these measures, India can regain its position as a leading garment exporter and drive economic growth and job creation.

Mains Question:

Discuss the challenges faced by India’s garment export sector and suggest measures to enhance its competitiveness in the global market. (250 words)

Source:The Hindu