INDIAN ECONOMY: GROWTH AND CONSIDERATIONS

Syllabus:

GS 3:

- Indian Economy and issues relating to Planning, Mobilization of Resources, Growth, Development and Employment.

- Inclusive Growth and issues arising from it.

Focus:

- The article discusses the current state of the Indian economy, highlighting its

- robust growth, challenges, and the need for sustainable and inclusive development.

- With recent economic data releases showing promising figures, there’s a call for caution and targeted strategies to maintain momentum and address lingering concerns.

Source: IE

Positive Economic Indicators:

- Thrive Continues: Indian economy showcases robust growth, stable inflation, strong FDI inflows, and healthy bank and corporate balance sheets.

- Impressive Q3: The third quarter of 2023-24 witnesses a GDP growth of 8.4%, coupled with a PMI Manufacturing peak at 59.1 in March.

- Credit Health: Credit ratio stands robustly at 192 in H2 of 2023-24, exceeding the 10-year average of 157, signalling the resilience of the corporate and banking sectors.

- FDI Surge: Foreign Direct Investment (FDI) inflows reach a notable $41 billion in 2023-24, elevating India’s forex reserves to around $643 billion.

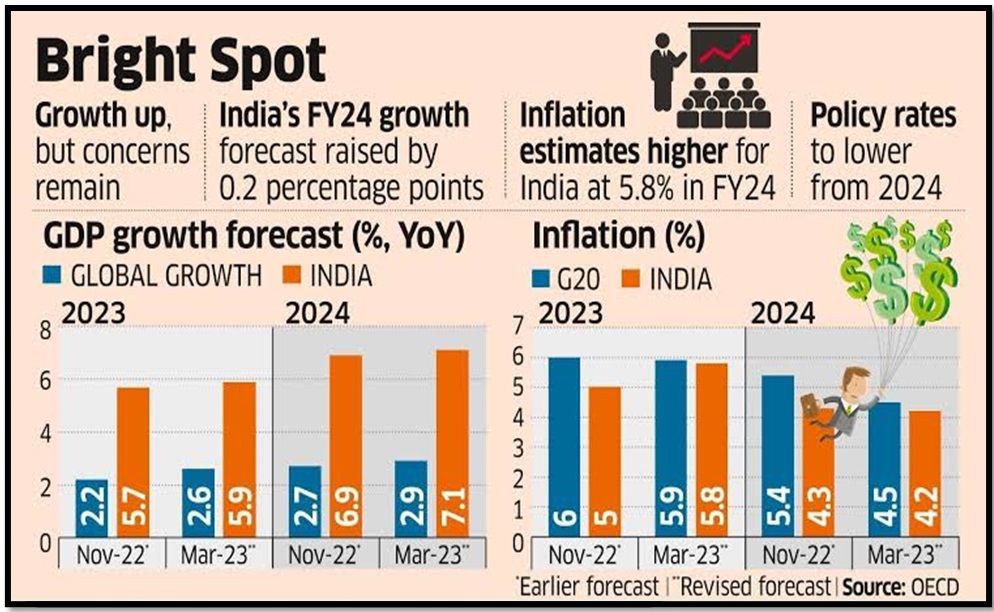

- Optimistic Outlook: With strong economic indicators, GDP growth is projected to be around 7% in the ongoing financial year.

Growth Insights and Concerns:

- Growth Momentum: India records over 8% growth in the first three quarters of 2023-24, hinting at a potential full-year growth surpassing the estimated 7.6%.

- Investment Driven: The surge in GDP is predominantly led by investment, while consumption growth appears restrained.

- Subdued Consumption: Consumption GDP registers a modest 3% growth this year, compared to the pre-pandemic level of 7% in 2018-19.

- Spending Patterns: Despite spending spikes in sectors like automobiles and housing, lower price-point categories like FMCG and apparel witness cautious consumer spending.

- Rural Recovery: Rural demand displays a promising recovery, with FMCG volume growth improving from 2.2% to 6.2% in the latter half of 2023.

Private Sector Investment and Economic Growth:

- Capital Expenditure: Government maintains its focus on capex, but a rise in private investment is pivotal for sustained growth momentum.

- Diverse Investments: Private sector demonstrates increased investment across sectors including steel, cement, petrochemicals, and renewable energy.

- Capacity Utilization: Manufacturing sector’s capacity utilization stands at 74%, suggesting an impending acceleration in private capex.

- Intent to Invest: CMIE data reveals a growing intent of private sector investment, promising future economic expansion.

- Order Book Surge: The order book of capital goods companies sees a sharp rise in the last fiscal year, further bolstering economic prospects.

Sectoral Performance and External Demand:

- Sectoral Growth: Manufacturing and services sectors predominantly drive India’s economic growth in 2023-24.

- Top Performers: Sectors like hotels, auto components, healthcare, and pharmaceuticals report commendable growth.

- Challenged Sectors: Chemicals, textiles, and polished diamonds face setbacks due to weak external demand.

- Exports Scenario: While merchandise exports grapple with global slowdowns, services exports remain resilient, especially in software and business consulting.

- Current Account Health: Estimated at a benign 0.6-0.7% of GDP for 2023-24, and around 1% for 2024-25, indicating economic stability.

Inflation, FDI Inflows, and Economic Stability:

- Moderating Inflation: CPI inflation is anticipated to moderate to around 4.8% in 2024-25 from an estimated 5.4% in 2023-24.

- FDI Momentum: Strong FDI inflows expected to persist in 2024-25, benefiting from Indian government bond inclusion in global indices.

- Inflation Concerns: Persistent high food inflation, particularly in vegetables (50%), pulses (19%), and spices (14%), remain a challenge.

- Central Bank Actions: RBI may consider a policy interest rate cut in H2 of the fiscal year, contingent on US Fed’s rate decisions.

- Retail Credit Surge: Despite rising interest rates, a substantial rise in retail credit is observed, reflecting changing consumption patterns and credit accessibility.

Retail Credit Growth and Banking Sector:

- Credit Surge: Retail credit growth remains high at around 18%, underscoring the changing consumption and savings patterns.

- Risk Management: RBI enhances banks’ risk weightage for unsecured personal loans to curb excessive personal loan growth.

- Banking Vigilance: Banks need to remain vigilant due to weak deposit growth, posing liquidity risks and pressuring net interest margins.

- Asset Quality: Despite robust credit growth, banks’ asset quality remains healthy, providing a cushion against potential risks.

- Liquidity Concerns: Strong credit growth juxtaposed with weak deposit growth highlights potential liquidity challenges for banks.

Way Forward for the Indian Economy:

Boost Consumer Confidence: Incentivize spending in key sectors to revive consumption-driven growth.

Enhance Rural Economy: Strengthen infrastructure and introduce targeted schemes to maintain rural demand growth.

Foster Private Investment: Simplify regulations and offer fiscal incentives to encourage private sector investments.

Diversify Export Strategy: Reduce dependency on specific sectors and countries to manage global economic fluctuations.

Address Liquidity Concerns: Promote savings, boost deposit growth, and implement effective liquidity management in the banking sector.

Prioritize Inclusive Growth: Adopt policies that reduce income disparities, promote sustainable development, and address environmental concerns.

Digital Push: Structural developments like digitalization and increased formalization have raised India’s potential growth trajectory.

Quality Focus: It’s pivotal for the government to emphasize quality growth and remain cautious of potential economic risks.

Fiscal Responsibility: With a new government soon to take charge, continued focus on fiscal consolidation and debt reduction is crucial.

Conclusion:

The Indian economy is comfortably placed, with an estimated GDP growth of around 7% in the current fiscal year. As a new administration is on the horizon, there should be an amplified focus on promoting inclusive and sustainable economic growth.

Source:

Mains Practice Question:

Discuss the recent economic performance of India, highlighting the growth drivers and challenges. Suggest measures for ensuring sustained and inclusive economic growth in the country.

Associated Articles:

https://universalinstitutions.com/download-types/indian-economy/