“INDIAN CORPORATES RAISE ₹85K CRORE THROUGH EQUITY ISSUANCES IN FY25”

Why in the news?

- Indian corporates mobilized nearly ₹85,000 crore through equity issuances, including IPOs and preferential allotments, in April and May FY25.

- SME IPOs led the surge, with 44 companies getting listed amidst SEBI concerns over potential price manipulation.

source:quora

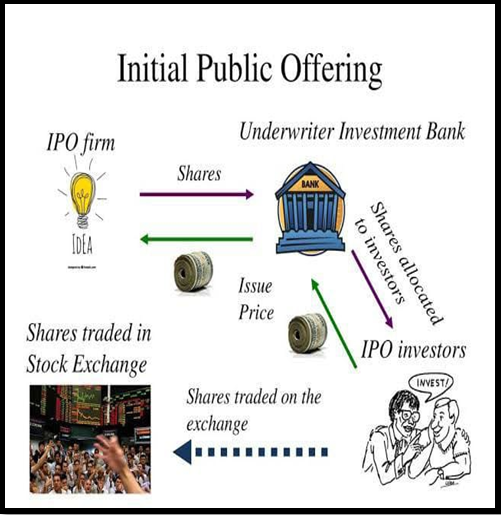

About Initial Public Offering (IPO):

- Initial Public Offering (IPO) is the process by which a privately held company, or a government-owned entity, raises funds by offering shares to the public or new investors.

- Post-IPO: After an IPO, the company is listed on the stock exchange.

- Stock Exchange: An organized market for the sale and purchase of securities such as shares, stocks, and bonds.

- Future Capital: A listed company can raise additional share capital through a Follow-on Public Offering (FPO).

About Securities and Exchange Board of India (SEBI):

Associated Article: |