INDIA TO EASE FOREIGN INVESTMENT RULES IN INSURANCE

Why in the news?

- The Indian government is considering reforms to remove the requirement for resident Indian citizens on the boards and top management of insurers. foreign-owned.

- Changes to rules on dividend payouts and board composition for insurers with foreign investment exceeding 49% are also under

- These reforms aim to attract more foreign capital to the insurance sector, following a tepid response to the 2021 increase in the FDI limit from 49% to 74%.

Key Provisions of the Rules

- Total Foreign Investment includes direct and indirect foreign

- Direct investment is FDI; indirect is through Indian controlled by foreigners. entities.

- Over 49% foreign requires half the investment board as independent directors, or one- third if the chairperson is independent.

- Majority of directors and key management must be resident Indians.

- At least one key position (chairperson, MD, CEO) must be a resident Indian.

- Compliance required within one year.

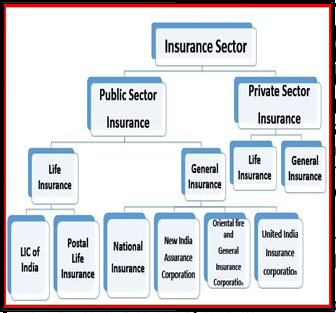

| About Insurance Sector in India Legal Framework:

Insurance Act of 1938:

Nationalisation of Life Insurance (1956):

About Insurance Regulatory and Development Authority of India (IRDAI):

IRDAI Vision 2047: Objective:

Key points: Foreign Direct Investment (FDI): Definition: Investment by a foreign resident in an unlisted Indian company or in 10% or more equity of a listed Indian company. Examples:

|