INDIA PUSHES FOR CARBON TAX INCLUSION IN EU TRADE TALKS

Why in the news?

India has successfully advocated for including the Carbon Border Adjustment Mechanism (CBAM) in EU trade negotiations, aiming to ease the impact on Indian steelmakers and align standards.

About EU Free Trade Negotiations on Carbon Tax :

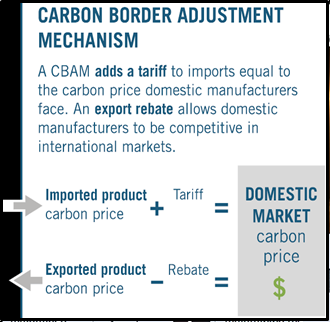

- India has successfully pushed for the inclusion of the Carbon Border Adjustment Mechanism (CBAM) in its free trade agreement (FTA) discussions with the European Union (EU).

- The CBAM proposes taxing imports of carbon-intensive products such as iron, steel, cement, aluminium, and fertiliser.

- This tax was initially excluded from FTA talks to expedite negotiations, but India now seeks to integrate it into the FTA to mitigate its impact.

- Indian officials are also advocating for a similar arrangement with the UK, though the UK has not yet agreed.

source:editionorg

Impact on Indian Steelmakers:

- Including CBAM in the FTA could significantly benefit Indian steelmakers, who export a large volume of steel to Europe, making it a crucial market.

- Nearly half of the 8.8 million tonnes of steel exported by Indian mills in FY24 went to Europe, highlighting its importance.

- Indian steelmakers argue that emission standards under CBAM should differ for developing countries, advocating for lower reduction targets compared to developed nations.

| About Carbon Tax and Its Impact:

Definition and Purpose:

Reduction in Air Pollution:

Economic and Environmental Benefits:

About European Union:

Associated Article: https://universalinstitutions.com/cop27-india-china-brazil-south-africa-oppose-carbon-border-tax/ |