INDIA BECOMING A TRADING NATION

Syllabus:

GS 3:

- Stock market and Trading in India .

- Current Concerns and Trends

Why in the News

Speculative buying triggered by new retail traders as well as the impact of finfluencers has been a significant concern especially in recent days. The SEBI and the National Stock Exchange among other financial regulatory authorities have put in measures to contain these risks and encourage high disclosure levels in the markets.

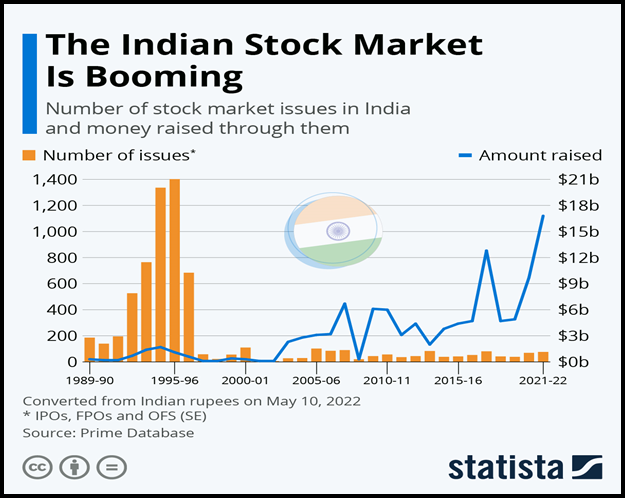

Source: Statista

| What are Finfluencers?

Finfluencers or financial influencers are persons or companies providing recommendations based on certain topics concerning finance including investments, trades, personal finances, among others from social media platforms or blogs. In most cases they have a large group of followers and often can affect the actions of these followers regarding their money. |

Surge in Trading Culture

- Tech Accessibility: The ability to acquire cheap smartphones and affordability of the internet has sparked trading for the diverse population especially younger people.

- User-Friendly Platforms: The introduction of the new trading apps with simple layouts means that more people today are trading as compared to the past.

- Youth Involvement: Currently, many young people, especially those less than 30 years of age have invested heavily in stocks due to increased market access to the perception and convenience of getting rich quick.

- Cultural Shift: This has brought about a culture of high-frequency trading where people depict high level of trading without proper understanding of the consequences.

- Boom in Participants: The absolute level of participation in stock and derivatives trading activities has increased, which have facilitated the country’s emergence as a trading nation.

What is the Stock Market?

Laws for Regulation: SEBI Act, 1992:

Securities Contracts (Regulation) Act, 1956 (SCRA):

|

Risks of Financial Derivatives

- High Losses: Financial derivatives trading has posed a lot of problems to most of the traders particularly those in the retail category; 90% of all the traders trading in financial derivatives lost their money inclusive of the trading fees.

- SEBI Insights: According to SEBI, 25 million unique investors in the index derivatives segment have a face value loss of ₹51,689 crore which makes the investors understand the risk associated with these trades.

- Young Traders at Risk: Fashion, retail, and technology stocks are becoming popular among younger investors especially those under 30 and majority are trading in stocks with high risks and thus higher chances of losing their investments.

- Intraday Trading Pitfalls: Intraday trading has become quite common with the increasing percentage of these traders reporting losses further from the earlier 65% in 2018-19 to 71%.

- Persistent Behaviour: Most traders who engage in financial derivatives trading are always being frustrated by losses but still they will continue to engage in the business due to probable gain.

Influence of Finfluencers and Brokerages:

- Affiliate Marketing: The finfluencers, financially motivated influencers, have also encouraged people to trade using referral links that fetch them commissions from stock Brokerages.

- Promoted Risk-Taking: Huge risks to engage in high frequency trading, which most followers are led by finfluencers without knowledge that the finfluencers have a financial interest in a brokerage.

- Ethical Concerns: Finfluencers’ behaviour has raised concerns with regards to inexperienced traders due to lack of transparency or even urging the inexperienced traders to engage in high risk trading.

- Brokerage Profits: There has been higher trading activity mainly driven by finfluencers resulting into conduction of more trades therefore increasing brokerage revenues in terms of commissions and with lower commission per trade due to the increased turnover.

- Undisclosed Profits: This is exorbitant business profits have been made by brokerages from the reduced transaction fees as they have kept the rebates to themselves.

Regulatory Actions

- New Fee Rules: New rule that will take effect from 2 October is that, brokerages will no longer be allowed to keep rebates but they will be forced to charge traders the amount that is similar to the transaction fees charged by the stock exchanges.

- Advertising Transparency: The ASCI in recent times has made it mandatory for the finfluencers to identify their affiliate links as advertisements.

- Affiliate Registration: The National Stock Exchange (NSE) expects finfluencers promoting products through affiliate marketing to be registered Authorized Persons that have sought exchange approval.

- Impact on Finfluencers: These new regulations have relatively impacted finfluencers and low-cost brokers as most of the brokerages have now stopped offering any remuneration to finluencers.

- Investor Protection: Such changes are meant to reduce the extent of finfluencers engaging in the mis-selling of financial products as well as increase the level of protection offered to the retail investors.

The Attraction of Trading

- Psychological Pull: However, due to high risks and low chances of success, more and more people are being drawn into trading with the hope of making quick bucks, especially the youths.

- Hope for Gains: Traders continue in risky operations because they expect they will end up having profit despite losses each time.

- Cultural Influence: The increased trading activity at the Indian exchanges is indicative of a rising culture of gambling and seeking for quick riches in the society.

- Lack of Awareness: Lack of awareness as to hazards of trading explains why retail investors still engage in dangerous financial activities.

- Regulatory Impact: Thus, although newly issued rules are going to eventually result in trading that will be more responsible, this phenomenon will remain an integral part of the Indian identity, creating the future of trading.

Way Forward

- Enhance Investor Education: Seek to support massive sensitization on potential hazards of high frequency and derivatives trading among traders mostly the youth through policies and financial literacy.

- Stricter Regulation of Finfluencers: Promote the policy on disclosing financial relationships compulsory to finfluencers so that the retail investors do not lose out to biases.

- Promote Long-Term Investment: Thus, it is necessary to persuade retail investors pay more attention to the long-term stock investments instead of short-term or derivatives speculation.

- Strengthen Regulatory Oversight: It would be useful to again have the regulations updated from time to time in order to address risks in the trading ecosystem and to better protect the individual shareholders.

- Incentivize Responsible Trading: Offer rewards for the brokers’ and platforms’ proper business conduct in trading and punish the recklessness in the financial market.

- Technology-Driven Solutions: Use of technology in giving real time risk reports of situation that can potentially endanger the traders and warn them on the activities that they are conducting that are risky.

Conclusion

Therefore there is a need to develop better practices in investors’ protection and share better knowledge of financial risks with inexperienced traders engaging in high risk operations. As seen, through transparency and other responsible trading practices, India can protect the retail investors as well as make the financial market more stable and fair.

Source: Mint

Mains Practice Question

Analyse the effects of the rising power of financial influencers or ‘finfluencers’ on the retail trading in the Indian market. Assess the prevention measures adopted by the regulators in a bid to shield the retail investors from potential disasters occasioned by HF and Derivatives trading.

Associated Article:

https://universalinstitutions.com/the-social-benefits-of-stock-market-speculation/