INCOME TAX DEPT MANDATES PAN-AADHAAR LINKING BY MAY 31 TO AVOID HIGHER TAX DEDUCTION

Why in the news?

- The income tax department urges taxpayers to link PAN with Aadhaar by May 31.

- Failure to link PAN with Aadhaar may result in tax deduction at a higher rate, as per income tax rules.

- If PAN is not linked with Aadhaar, TDS is required to be deducted at double the applicable rate.

source:slideshare

About PAN-Aadhaar linking:

- The Income Tax Department automates PAN issuance using Aadhaar for return filing.

- Demographic data obtained from UIDAI eliminates the need for additional documents.

- PAN serves as an identifier for all tax-related transactions, ensuring compliance.

- Aadhaar’s comprehensive information simplifies the PAN application process.

- Interchangeability of PAN and Aadhaar for tax filing, enhancing taxpayer convenience.

- Objective is to enhance tax compliance and streamline taxpayer experience.

What is an Aadhaar ?

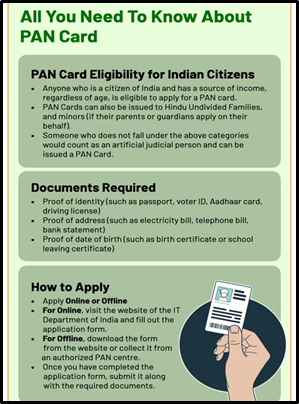

About PAN Card:

|