Income-tax Bill, 2025: Simplifying India’s Direct Tax Framework

Syllabus:

GS-3:

Mobilization of Resources , Fiscal Policy

Focus:

The Income-tax Bill, 2025, introduced in the Lok Sabha, aims to replace the Income-tax Act, 1961, by removing outdated provisions, simplifying tax laws, and reducing litigation. It introduces clear tabular formats, eliminates redundant sections, and replaces the ‘Assessment Year’ with ‘Tax Year’, ensuring a more transparent and efficient taxation system.

Key Features of the Income-tax Bill, 2025:

Shorter and Simpler Legal Framework

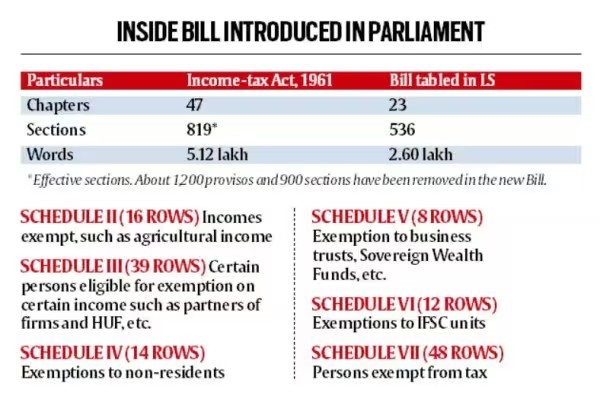

- The new Bill is 24% shorter than the Income-tax Act, 1961, with 622 pages compared to the previous 823 pages.

- The number of sections has been reduced from 819 to 536, removing redundant provisions, provisos, and explanations.

- The word count has been almost halved from 12 lakh words to 2.60 lakh words.

- The number of chapters has decreased from 47 to 23, consolidating provisions spread across multiple chapters into a more organized structure.

Tabular Representation for Clarity

- The Bill introduces 57 illustrative tables, compared to just 18 tables in the 1961 Act.

- It provides a structured format for important tax provisions such as deductions, exemptions, and TDS/TCS rates.

- This makes it easier for taxpayers to understand eligibility, benefits, and obligations without complex legal jargon.

Enhanced Transparency and Stability

- The Bill maintains continuity in taxation principles, ensuring that businesses and individuals face no sudden disruptions.

- It does not introduce any major changes in tax penalties or compliance rules, ensuring predictability and stability.

- The First Schedule of the Bill does not mention tax rates for the old tax regime, meaning future tax rates will be decided in annual Finance Acts.

Evolution of Income Tax in India:

- Income-tax Act of 1922: Established a structured tax system by formalising income tax authorities and administration.

- Central Board of Revenue Act (1924): Created the Central Board of Revenue to administer income tax.

- Recruitment of Group A Officers (1946): Introduced professional training in Bombay and Calcutta.

- National Academy of Direct Taxes (1957): Strengthened training and development for tax officers.

- Income Tax Act of 1961: Replaced the 1922 Act and came into force in April 1962, applicable across India.

- Bifurcation of Central Board of Revenue (1964): Separated into the Central Board of Direct Taxes (CBDT) and the Central Board of Excise and Customs (CBEC) for efficient tax administration.

- Technological Advancements:

- 1981: Introduction of computerisation for processing challans.

- 2009: Centralized Processing Centre (CPC) in Bengaluru for e-filing and paper return processing.

- E-Verification Scheme: Helps authorities track taxpayer income, reduce evasion, and provide financial data.

- Vivad Se Vishwas Scheme: Aims to settle pending direct tax disputes and increase government revenue.

What is Income Tax?

- Definition: A government levy on income earned by individuals and businesses. Defined under Section 2(24) of the Income Tax Act, 1961.

- Sources of Income:

- Salary: Includes basic pay, allowances, commissions, and retirement benefits.

- House Property: Rental income from residential or commercial properties.

- Business/Profession: Taxable profits after deducting expenses.

- Capital Gains: Profits from selling assets like property or jewellery (long-term/short-term).

- Other Sources: Interest, family pension, gifts, lottery winnings, and investment returns.

Importance of Income Tax

- Revenue Generation: Funds essential services, security, and economic development.

- Wealth Redistribution: Helps balance income inequality and social structure.

- Governance & State Capacity: Expands government reach, improves tax compliance, and enhances legitimacy.

- Societal Welfare: Ensures a self-sustaining economy through efficient tax collection and reforms.

Current Landscape

- Growth in Personal Income Tax (PIT):

- 2020-21: ₹5.75 lakh crore

- 2022-23: ₹9.67 lakh crore

- 2023-24: ₹12.01 lakh crore (provisional, as of April 2024)

- Tax Base Expansion:

- 58.57 lakh first-time Income Tax Return (ITR) filers in AY 2024-25.

- Total ITRs filed: 7.28 crore, reflecting economic formalisation.

- Institutional Progress:

- Revenue Growth: From ₹30 lakh to ₹20 lakh crore.

- Doubling of Tax Base and improved tax-to-GDP ratio.

- Reforms: Rationalisation of corporate tax and introduction of the new tax regime.

Changes in Taxation Framework:

Introduction of ‘Tax Year’ Instead of ‘Assessment Year’

- The concept of ‘Assessment Year’ (AY) has been replaced with ‘Tax Year’, defined as the 12-month period starting from April 1.

- For businesses or professions set up mid-year, their tax year starts from the date of commencement and aligns with the financial year.

- Previously, taxpayers had to track two different periods—the Financial Year (FY) for earning income and the Assessment Year (AY) for tax assessment.

- This change simplifies compliance and aligns tax calculations directly with income earned in the same period.

Capital Gains and Exemptions

- The exemptions under Section 54E (related to capital gains on assets before 1982) have been removed.

- The Bill streamlines deductions and capital gains exemptions, removing outdated provisions that no longer serve taxpayers.

- The scope of income has been expanded to include new forms of digital and evolving income sources.

Virtual Digital Assets and Crypto as Capital Assets

- Cryptocurrencies and virtual digital assets (VDAs) have been classified as capital assets, similar to:

- Land and buildings

- Shares and securities

- Bullion, jewellery, and artwork

- This means that income from digital assets will be taxed under capital gains taxation rules, providing clarity on crypto taxation.

- The Bill maintains the existing definition of Virtual Digital Assets (VDAs) as per Finance Bill, 2022, without making any new changes.

Strengthening Compliance and Dispute Resolution:

Revised Dispute Resolution Mechanism

- The Dispute Resolution Panel (DRP) section now provides clear guidelines on determinations, decisions, and justifications.

- Earlier, the DRP lacked clarity on how its directions should be framed, leading to confusion in legal proceedings.

- The revised provisions improve transparency and reduce ambiguity, making tax dispute resolution more predictable and efficient.

Expanded Powers of Tax Authorities

- Income tax authorities now have the power to access digital platforms for investigation, including:

- Email servers and social media accounts

- Online banking and trading platforms

- Cloud storage and digital application platforms

- This enables authorities to track income sources, verify tax compliance, and prevent tax evasion more effectively.

TDS/TCS and Other Procedural Improvements

- TDS (Tax Deducted at Source) and TCS (Tax Collected at Source) rules have been presented in a simplified tabular format.

- This makes it easier for taxpayers to understand their obligations and ensures better compliance.

- Standard deductions from salary, such as gratuity and leave encashment, have also been structured in a clear table format.

The Road to the New Bill:

Evolution of India’s Direct Tax Code

- The Income-tax Bill, 2025, is a long-awaited reform, following multiple previous attempts to simplify India’s tax laws:

- UPA’s Direct Tax Code (DTC) was proposed in 2010 but did not pass.

- A task force in 2018 was formed to rewrite the tax laws, submitting its report in 2019.

- The 2024 Budget announced a review of the 1961 Act, culminating in the introduction of the Income-tax Bill, 2025.

Government’s Vision Behind the Bill

- Finance Minister Nirmala Sitharaman, in the 2024 Budget, emphasized the need for a simpler tax law, similar to the government’s criminal law reforms.

- The Bill aligns with the government’s efforts to bring more transparency, tax certainty, and reduced litigation.

Future Legislative Process

- The Bill will be reviewed by a Parliamentary Committee before being passed into law.

- The government will decide on possible amendments before finalizing the new tax framework.

- Once enacted, the new law will take effect from April 1, 2026.

Implications and Way Forward:

Benefits for Taxpayers

- Easier to Understand: The simplified structure and tabular format make the tax law more accessible to individuals and businesses.

- Reduced Litigation: Clearer provisions minimize disputes, making tax compliance smoother.

- No Sudden Policy Shifts: Continuity in tax rates and deductions ensures stability for taxpayers and investors.

Expected Challenges

- Lack of Major Compliance Reforms: While the Bill simplifies the law, it does not introduce significant changes in compliance or penalties.

- Implementation Hurdles: A large-scale transition from the 1961 Act to the new Bill will require extensive taxpayer education.

- Adaptation for Businesses: Companies may need to adjust accounting and taxation processes to align with new definitions and compliance norms.

Conclusion:

The Income-tax Bill, 2025, is a progressive step towards making India’s tax laws simpler, clearer, and more efficient. By reducing redundancy, consolidating provisions, and improving transparency, the Bill enhances taxpayer experience without disrupting the existing taxation framework. However, its true impact will depend on implementation efficiency, taxpayer awareness, and future amendments.

Source: IE

Mains Practice Question:

The Income-tax Bill, 2025, aims to streamline India’s direct tax system by simplifying provisions and enhancing transparency. Discuss the key features of the Bill, its impact on taxpayers, and the challenges in its implementation.(250 words)