IMPROVEMENT IN BANK NPAS

Why in the News?

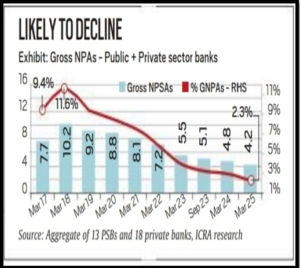

- Reserve Bank of India (RBI) data reveals a decline in scheduled commercial banks’ (SCBs) Gross Non-Performing Assets (GNPAs) from 3.9% at end-March to 3.2% at end-September.

- The agricultural sector maintains the highest GNPA ratio, while retail loans exhibit the lowest at end-September.

The Data :

- The industrial sector sees enhanced asset quality, with its GNPA ratio reaching 4.2% at end-September 2023.

- Notably, large industries show a significant reduction in GNPA ratio from 22.9% at end-March 2018 to 4.6% at end-June 2023.

Source: The Hindu

About NPA :

- NPA categorizes loans or advances in default, indicating failure in scheduled payments of principal or interest.

- Typically, debt qualifies as non-performing when payments remain overdue for a minimum of 90 days.

- In agriculture, NPA status is assigned if both principal and interest remain unpaid for two consecutive cropping seasons.

- Banks are required to classify NPAs further into Substandard, Doubtful and Loss assets.

- Substandard assets: Assets which has remained NPA for a period less than or equal to 12 months.

- Doubtful assets: An asset would be classified as doubtful if it has remained in the substandard category for a period of 12 months.

- Loss assets: As per RBI, loss asset is considered uncollectible and of such little value that its continuance as a bankable asset is not warranted, although there may be some salvage or recovery value.

- Types of NPAs:

- Gross NPA: Represents the total value of defaulted loans by individuals.

- Net NPA: Signifies the amount realized after deducting the provision amount from the total gross non-performing assets.

Source: The Hindu

Source: The Hindu