Improved Repo Rate Transmission Enhances Monetary Effectiveness

Improved Repo Rate Transmission Enhances Monetary Effectiveness

Syllabus:

GS-3:

Banking Sector & NBFCs , Statutory Bodies , Monetary Policy , Growth & Development

Focus:

The Reserve Bank of India (RBI) has improved its monetary policy transmission significantly over the past few years, especially in the context of repo rate adjustments. A combination of regulatory shifts, such as adoption of external benchmark lending rates (EBLR) and marginal cost lending rate (MCLR), has led to better policy effectiveness.

Understanding Repo Rate and Monetary Policy:

- The repo rate is the interest rate at which RBI lends to commercial banks, a key instrument of monetary policy.

- Changes in repo rates aim to influence borrowing costs, liquidity, and economic activity.

- For monetary policy to be effective, repo rate changes must be transmitted to deposit and lending rates.

Historical Challenges in Rate Transmission

- Traditionally, poor transmission of repo rate changes has hampered RBI’s ability to manage inflation and growth.

- Reasons include rigid interest rate frameworks, administered lending mechanisms, and delayed adjustments by banks.

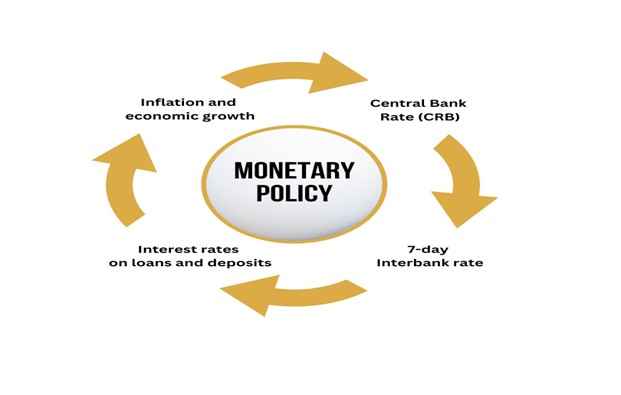

What is Monetary Policy?● Monetary policy refers to actions by a central bank (RBI in India) to control money supply and credit in the economy. ● Objectives include price stability, economic growth, and financial stability. ● Major tools: ○ Repo Rate: Rate at which RBI lends to commercial banks. ○ Reverse Repo Rate: Rate at which RBI borrows from banks. What is Monetary Policy Transmission (MPT)? ● MPT is the process through which policy rate changes influence the broader economy. ● Involves passing repo rate changes to: ○ Inter-bank rates, ○ Deposit and lending rates, ○ Bond yields, ○ Asset prices (stocks, real estate). ● The aim is to achieve stable inflation and sustainable growth. Role of RBI in MPT ● The RBI (Amendment) Act, 2016 mandates price stability and growth. ● The Monetary Policy Committee (MPC) sets the repo rate to meet the 4% inflation target. ● RBI ensures smooth MPT by monitoring and correcting transmission lags. Role of Banks in MPT ● Banks adjust deposit and lending rates based on policy rate changes. ● Lower repo rates → cheaper loans → higher demand and investment. ● Banks play a crucial role in passing policy effects to the real economy. |

Recent Policy Developments:

Shift to Accommodative Stance

- RBI recently adopted an ‘accommodative’ stance, signalling a readiness to reduce rates further if needed.

- It has clarified its stance to indicate flexibility in monetary easing, especially as inflation is projected at 4% for 2024–25.

Favourable Macroeconomic Conditions

- Normal monsoon forecasts by the India Meteorological Department (IMD) support lower inflation risks.

- RBI has slightly downgraded GDP growth projections, further strengthening the case for potential repo rate cuts.

- Liquidity has been abundantly provided, keeping the system in surplus and supporting smooth transmission.

Enhancements in Transmission Mechanisms:

External Benchmark Lending Rate (EBLR) for Retail

- Introduced to ensure direct linkage of loan rates to repo rate for retail loans and SMEs.

- As of now, 85% of private banks’ loans and 45% of public sector bank loans are linked to EBLR.

- This mechanism has ensured faster and fuller transmission for these sectors.

Marginal Cost Lending Rate (MCLR) for Corporates

- Corporate lending rates are governed by MCLR, which depends on deposit rates.

- MCLR is formula-driven and changes only when banks adjust deposit rates based on fund flow dynamics.

- Public sector banks, with lower EBLR coverage, are slower in transmission than private peers.

Empirical Analysis: Seven Repo Regimes Since 2011:

Data Insights on Rate Transmission

- Since 2011, seven major repo rate regimes have seen varied transmission responses:

- In 2011–12, a 200 basis points hike in repo led to a 100 bps rise in deposit rates and 5 bps in lending rates.

- 2015–18, repo was cut by 200 bps, deposit rates by 175 bps, and lending rates by 5 bps.

- 2019–22, a 225 bps cut led to 70% transmission in deposits and 69% in MCLR — the best-case scenario so far.

- 2022–25, a 250 bps hike had 53% transmission in deposit rates and 60% in MCLR.

Key Observations

- Transmission has improved since the adoption of MCLR in 2016.

- The switch from base rate to MCLR increased sensitivity to policy changes.

- Retail loans have better rate alignment due to EBLR, but corporate loans still face transmission lags.

Influencing Factors and Future Outlook:

Rise of Mutual Funds and Savings Migration

- Mutual fund industry growth (AUM growth: 53% and 77% in recent regimes) has made banks cautious in lowering deposit rates.

- Investors often shift funds from low-interest deposits to higher-yielding market instruments, affecting banks’ liquidity planning.

Outlook for 2025 and Beyond

- If repo is cut by 100 basis points in 2025, expected transmission is around 60–70 basis points in lending rates.

- Deposit rates will likely remain more stable, limiting full transmission.

- Nonetheless, compared to earlier years, monetary transmission is more responsive, showing a maturing financial system.

Conclusion:

India’s monetary policy transmission has improved notably, thanks to structural reforms like EBLR and MCLR. Though deposit rate rigidity persists, particularly due to competition from mutual funds, the overall responsiveness of lending rates to repo changes indicates a more effective and agile monetary framework than a decade ago.

Source: MINT

Mains Practice Question:

Discuss the significance of improved monetary policy transmission in India. Highlight the role of repo rate-linked mechanisms, such as EBLR and MCLR, in enhancing the effectiveness of RBI’s policy decisions. Also examine challenges to full transmission, particularly in the context of corporate lending and deposit rate stickiness.