IMPACT OF CORPORATE TAX CUTS ON WAGES

Why in the news?

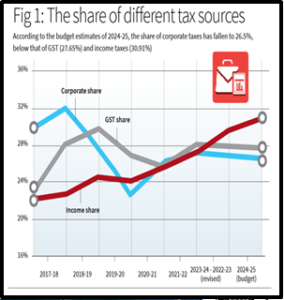

Recent evaluations reveal that corporate tax cuts in the U.S. and India led to minimal wage increases and significant revenue losses, shifting the tax burden to individuals.

source:TH

India’s Corporate Tax Cuts:

- Tax Reduction: In September 2019, India reduced corporate tax rates for existing companies from 30% to 22% and for new companies from 25% to 15%.

- Revenue Loss: This resulted in a tax revenue loss of approximately ₹1 lakh crore in 2020-21.

- Employment Trends: Although employment and labour force participation increased, corporate tax cuts had limited effect on job security and wages. Unpaid family work and insecure jobs increased.

What is Corporate tax?

Significance:

Associated Article: |