IMF’S SOVEREIGN DEBT RISK ASSESSMENT

Syllabus:

- GS 3: Indian Economy and issues relating to Growth and Development.

Why in the News?

- The Finance Ministry’s response to the IMF’s sovereign debt risk assessment for India has sparked debates over the nation’s fiscal stance.

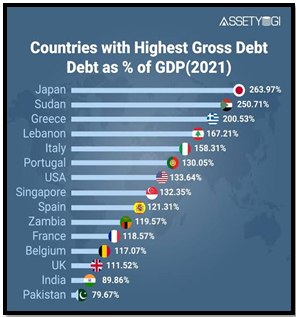

- This response came after the IMF released details of its Article IV consultations with India, projecting potential scenarios of India’s general government debt exceeding 100% of GDP by 2027-28.

Source: AssetYogi

India’s Response:

- The Finance Ministry’s statement aimed to rectify what it perceived as presumptions and misinterpretations arising from the IMF’s projections.

- It stressed that the IMF’s 100% of GDP scenario was a “worst-case” projection, not a definitive outcome, comparing it to even higher extreme scenarios projected for other countries like the U.S., U.K., and China.

What is IMF’s Article IV Consultations?

- Article IV Consultations is an important instrument of IMF which helps in evaluating the economic health of various countries.

- During Article IV consultations, the IMF engages in annual bilateral discussions with its members,

- Subsequently, its staff compiles a report.

- Restructuring and enhancing the Article IV consultation process are imperative to leverage new technologies and maximize the utility of available public data.

| Sovereign Debt

· Sovereign debt pertains to the debt that a government issues or accrues. Governments resort to borrowing funds to cover expenses beyond their standard tax revenues. · Typically, they are obligated to repay both the principal amount and interest on the borrowed debt over time, although some governments opt to acquire new debt to settle existing obligations. Understanding Debt-to-GDP ratio What is Debt to GDP ratio? · The Debt-to-GDP ratio is a financial metric that quantifies a country’s total debt as a percentage of its Gross Domestic Product (GDP). · It serves as an indicator of the nation’s ability to manage its debt relative to the size of its economy. · This ratio offers insights into fiscal health, signaling potential risks associated with higher debt burdens or highlighting the stability achieved with lower levels of debt in relation to economic output. Sustainable Debt to GDP ratio: · Sustainable Debt-to-GDP Ratio, as per the IMF, is defined as follows: “A country attains sustainable external debt when it fulfills both current and future external debt service obligations completely, without accruing additional debt and without impeding growth.”

Previous Projections: · IMF projects a 17% increase in India’s public debt due to heightened spending in response to COVID-19. · The surge in public spending is attributed to revenue loss from economic lockdown in key industries during the pandemic. · Previous IMF projections indicated stabilization of the debt-to-GDP ratio by 2021, with a subsequent decline expected by the end of 2025, aligning with global trends. |

Key Highlights:

- India’s Current Debt Scenario:

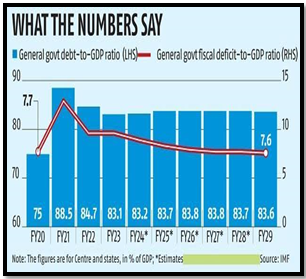

- Combined central and state government debt was 81% of GDP in 2022-23, a decline from 88% in 2020-21.

- Under favourable conditions, the IMF suggests a potential decrease to 70% by 2027-28.

- Global Shocks Impact:

- Points out that global shocks, like the 2008 financial crisis and the recent pandemic, have affected the entire world economy.

- Indicates India’s challenges are not isolated but part of broader global economic dynamics.

- Semantics of the Ministry’s Statement:

- Debate arises over whether the Ministry’s communication was confrontational or clarificatory.

- India’s Director on the IMF Board had earlier expressed reservations about the staff’s conclusions on debt risks and other economic aspects.

- Perceptions and Fiscal Improvement:

- Over the past year, the IMF’s perceptions regarding India’s fiscal position have evolved positively.

- Initially highlighting risks to India’s fiscal space in 2022, the IMF now views sovereign stress risks as moderate.

- This change is partly attributed to India’s ability to meet fiscal deficit targets, which were about 57% of GDP last year.

Challenges:

- Interpretation and Misuse: The Finance Ministry’s statement aimed to prevent potential misinterpretation or misuse of the IMF’s projections, stressing that it wasn’t a direct rebuttal but a clarification.

- Confrontation vs. Clarification: Interpretations vary regarding the nature of the Ministry’s statement – whether it was confrontational or merely clarificatory, highlighting nuances in the diplomatic communications.

Way Forward:

- Communication Strategy:

- Develop a comprehensive communication strategy to convey nuanced economic assessments, ensuring clarity and avoiding misinterpretation.

- Foster transparency in sharing economic data and projections to build trust with international financial institutions.

- Fiscal Discipline and Debt Reduction:

- Strengthen efforts toward fiscal discipline, ensuring that fiscal deficit targets are met consistently.

- Prioritize reducing debt levels to enhance financial stability and signal commitment to sustainable economic practices.

- Global Cooperation:

- Advocate for global cooperation and understanding in interpreting economic assessments, recognizing the interconnectedness of economies.

- Collaborate with international bodies to establish standardized metrics and criteria for sovereign debt risk evaluations.

- Continued Reforms:

- Continue economic reforms aimed at bolstering growth, attracting investments, and diversifying revenue sources.

- Implement policies that address structural issues, fostering a resilient and dynamic economy capable of withstanding global shocks.

- Policy Adaptation:

- Periodically assess and adapt fiscal and monetary policies in response to evolving global economic conditions.

- Develop contingency plans to navigate potential adverse scenarios while maintaining flexibility for agile policy adjustments.

The evolving perceptions of India’s fiscal resilience underscore the nation’s commitment to reduce debt and maintain fiscal discipline. As India strives to align its fiscal trajectory with set targets, actions that reinforce fiscal commitments will be imperative in navigating future fiscal challenges.

Source:

Mains Practice Question:

Define the Debt-to-GDP ratio and its significance as an indicator of a country’s fiscal health. Discuss the challenges and opportunities India faces in managing its debt burden and achieving a sustainable fiscal future.

Source: AssetYogi

Source: AssetYogi Source: Business Standards

Source: Business Standards