IIFCL TARGETS ZERO NET NPAS AND 18% GROWTH IN FY25

Why in the news?

- India Infrastructure Finance Company Ltd (IIFCL) aims for 18% growth in FY25.

- Targets to achieve zero net non-performing assets (NPAs) within the current financial year.

source:freshersnow

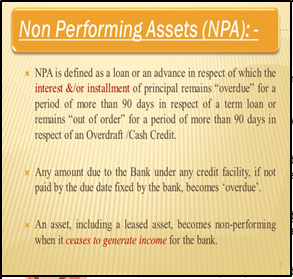

About Non-Performing Asset (NPA):

- Definition: A loan overdue for 90+ days, affecting various loan types.

- Impact: Reduces bank income, profitability, lending capacity, and increases loan defaults.

- Types:

- Sub-Standard Assets: NPAs for ≤12 months.

- Doubtful Assets: NPAs for >12 months.

- Loss Assets: Uncollectible, minimal recovery value left.

About the India Infrastructure Finance Company Limited (IIFCL):

|