IBC: Reviving Troubled Businesses and Economy

Relevance

- GS Paper 3 Indian Economy and issues relating to Planning, Mobilization of Resources, Growth, Development and Employment.

- Tags: IBC #NPA #debt #Banking #UPSC #CurrentAffairs #InsolvencyandBankruptcyCode.

Why in the News?

The Ministry of Corporate Affairs emphasizes professionalism among insolvency professionals (IPs), urging compliance with IBC regulations and the avoidance of conflicts of interest, amid a low 29.5% claims recovery rate in the June quarter.

Insolvency and Bankruptcy Code (IBC)

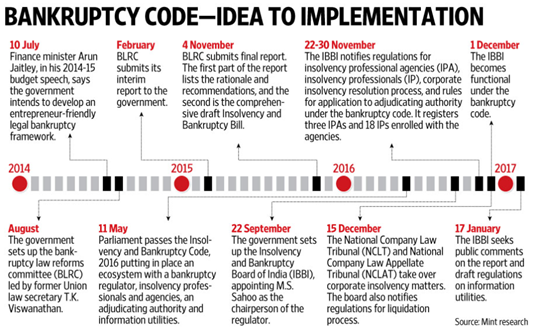

- The IBC was enacted in 28 May 2016 to address the escalating issue of non-performing loans (NPA) and create a unified framework for resolving insolvency cases promptly.

- Dual Objectives: The IBC aims to promote responsible debtor behavior and facilitate the revival of financially distressed companies, shifting from the ‘debtor-in-possession’ to ‘creditor-in-control’ model.

The Need for the IBC

- In 2016, India faced a significant challenge with mounting Non-Performing Assets (NPAs) and debt defaults.

- Traditional loan recovery mechanisms like the Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act (SARFAESI), Lok Adalats, and Debt Recovery Tribunals were proving ineffective.

- Consequently, the Insolvency and Bankruptcy Code (IBC) was introduced to revamp the corporate distress resolution framework in India.

Objectives of the IBC

- Consolidation of Laws: The IBC aimed to consolidate existing laws related to insolvency and bankruptcy into a single comprehensive framework.

- Time-Bound Resolution: It established a time-bound mechanism to address insolvency cases promptly, preventing delays in resolution.

- Creditor-in-Control Model: Unlike the earlier debtor-in-possession system, the IBC shifted the control to creditors, empowering them to make decisions regarding insolvency resolution.

Resolution vs. Liquidation

When insolvency is triggered, the IBC offers two possible outcomes—resolution or liquidation.

- Resolution: The primary objective is to resolve insolvency by devising restructuring plans or transferring ownership to new investors.

- Liquidation as a Last Resort: If resolution efforts fail, the company’s assets are liquidated to maximize creditor recoveries.

Process of Insolvency and Bankrupcty Code of India

Initiating the IBC Process

- Default by Corporate Debtor: When a corporate debtor (CD) defaults on loan repayment, either the creditor or the debtor itself can initiate the Corporate Insolvency Resolution Process (CIRP) under Section 6 of the IBC.

- Minimum Default Threshold: The minimum default amount for initiating insolvency was initially set at ₹1 lakh.

- However, in response to pandemic-induced economic challenges, the government raised this threshold to ₹1 crore.

Adjudicating Authority and Application Admission

- Approaching the Adjudicating Authority (AA): To file for insolvency, the applicant must approach the designated adjudicating authority (AA) under the IBC.

- National Company Law Tribunal (NCLT) for companies and Limited Liability Partnership handle insolvency cases, for individuals and Partnership Firms Debt Recovery Tribunal (DRT) handles insolvency cases

- Admission or Rejection: The Tribunal has 14 days to either admit or reject the application. If admission is delayed, the AA must provide a valid reason.

- Once admitted, the CIRP process commences, and the amended resolution timeline is 330 days.

Timeliness and Resolution Efficiency

- Initial Timeline: The IBC introduced a 180-day deadline for completing the resolution process, extendable by 90 days. This was aimed at ensuring timely resolution.

- Extended Timeline: Subsequent amendments extended the total timeline to 330 days, nearly a year, to accommodate more complex cases.

Role of Interim Resolution Professional (IRP)

- Appointment: Upon admission of the application, the Adjudicating Authority (AA) appoints an interim resolution professional (IRP) who is registered with an insolvency professional agency (IPA).

- IRP’s Responsibilities: The IRP takes control of the defaulter’s assets and operations. This includes gathering information about the company’s financial state from Information Utilities, repositories that track the debtor’s credit history.

Committee of Creditors (CoC)

The IRP also coordinates the formation of a Committee of Creditors (CoC).

- Composition: The CoC comprises unrelated financial creditors of the defaulting company.

- Key Decisions: The CoC decides whether the defaulting company is viable for restructuring or should undergo liquidation.

Insolvency Professional (IP)

- The CoC appoints an Insolvency professional (IP) who manages the company’s operations during CIRP.

- This IP can be the same as the IRP or a new professional.

Resolution Plan Process

- Resolution Plan Proposals: The IP invite and assesses proposals for a resolution plan, which may involve debt restructuring, mergers, or demergers.

- CoC Approval: Eligible plans are submitted to the CoC for approval, which requires at least 66% of the voting share among committee members.

- Plan Implementation: Once approved, the plan is submitted to the Tribunal for final approval, and the debtor is obligated to implement it. The AA may also reject a plan.

- Liquidation: If the CoC fails to approve any resolution plan, the company proceeds toward liquidation.

Introduction of Pre-packs (PIRP)

- In July, the IBC was amended to introduce pre-packs or PIRP for Micro, Small, and Medium Enterprises (MSMEs).

- PIRP allows creditors and business owners to agree out-of-court to sell the business to an interested buyer.

- This mechanism is currently limited to defaults not exceeding ₹1 crore.

Impact of IBC on the Indian Economy

- Promoting Disciplined Borrowing: The IBC has instilled discipline in borrowing practices as defaulting promoters fear losing control of their companies.

- Resolution Statistics: Thousands of insolvency cases have been resolved, reintroducing substantial funds into the banking system.

- Improvement in Global Ranking: India’s global ranking in resolving insolvency improved significantly, reflecting the IBC’s success.

- Ease of Doing Business Rise: Justice Sanjay Kishan Kaul attributes India’s improvement in the ‘Ease of Doing Business’ index to the Insolvency and Bankruptcy Code (IBC).

- Support for Startups: IBC fosters India’s startup culture by creating a favorable environment for entrepreneurs.

Challenges for the IBC in Achieving Its Objectives

Low Resolution Rate

- Objective Misalignment: The IBC prioritizes resolution as its primary objective, aiming to save businesses as going concerns. However, data reveals that over 50% of cases have resulted in liquidation.

- Declining Resolution Success: While early years saw better resolution rates, post-2018, most quarters witnessed a majority of cases ending in liquidation.

Asset Value Maximization

- Value Erosion: Liquidation of assets often leads to significant value erosion, which runs counter to the objective of maximizing asset value.

- Economic Efficiency: Failing to achieve resolutions efficiently affects economic viability and efficiency.

Promoting Entrepreneurship and Credit Availability

- Entrepreneurship Deterrent: Frequent liquidations may deter entrepreneurship, as businesses may hesitate to invest due to perceived insolvency risks.

- Credit Availability: The IBC’s success in balancing creditors’ interests with promoting credit availability remains a challenge.

Increased Delays

- In FY22, cases involving companies owing over ₹1,000 crore took a staggering 772 days for resolution.

- The average resolution duration has risen significantly over the past five years.

How to strengthen IBC?

Strengthening the IBC

Key stakeholders must work diligently to uphold the effectiveness of the IBC.

- Timely Resolutions: Timeliness in insolvency resolution is crucial to prevent further erosion of debtor assets.

Government’s Role

The government should allocate appropriate budgets for:

- Upskilling Professionals: Invest in training and upskilling insolvency professionals to enhance their capabilities.

- Tribunal Infrastructure: Improve tribunal infrastructure for efficient resolution processes.

- Digitization: Promote digitization of the insolvency resolution process to streamline proceedings.

The IBC has successfully tackled the NPA crisis, contributing approximately ₹2.5-lakh crore back into the banking system since 2016. While the IBC has achieved significant progress, there is ample room for further improvement to align with global standards in insolvency resolution.

Source: The Hindu, Indian Express

Mains Question

Discuss the objectives and key provisions of the Insolvency and Bankruptcy Code, 2016, and analyze its impact on the resolution of non-performing assets in India. What are the challenges and opportunities associated with its implementation?