How swps can help retires beat inflation, manage risks

Syllabus:

GS 3:

- Indian Economy and Issues

- Investments and effects on Growth.

Focus:

The Systematic Withdrawal Plan (SWP) is gaining attention as a flexible investment tool for retirees to manage inflation, generate regular income, and minimize risks, offering a tax-efficient alternative to traditional fixed deposits.

Overview of Systematic Withdrawal Plans (SWP)

- Definition: A Systematic Withdrawal Plan (SWP) allows retirees to withdraw a fixed amount regularly from a mutual fund, ensuring steady income.

- Structure: SWP is the reverse of a Systematic Investment Plan (SIP), where money is withdrawn periodically rather than invested.

- Tax Efficiency: Tax benefits are maximized when the mutual fund has less than 65% debt, attracting a 12.5% long-term capital gains tax.

- Example: For an 8% withdrawal rate, ₹30,000 can be withdrawn monthly from a ₹50 lakh corpus, depending on fund returns and equity performance.

- Flexibility: SWP offers flexibility to retirees in adjusting withdrawal amounts based on the performance of their mutual fund and inflationary changes.

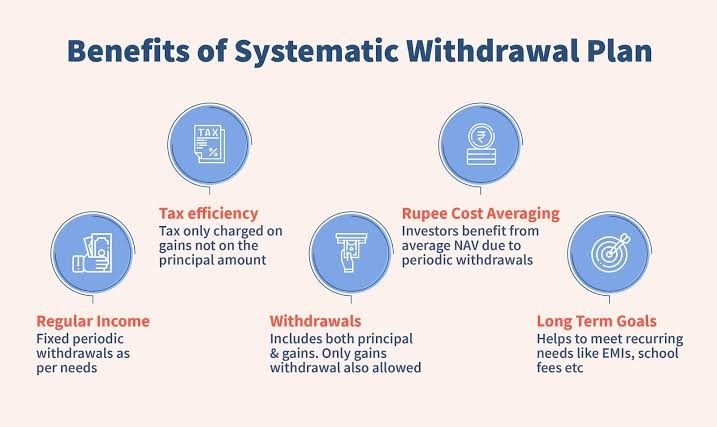

Benefits of SWP for Retirees

- Income Stability: Retirees receive regular, predictable income, helping them meet their post-retirement expenses in a structured manner.

- Adjustability: The SWP amount can be adjusted based on the retiree’s evolving financial needs, ensuring sustainability of the retirement corpus.

- Asset Allocation: SWPs help maintain a balanced asset allocation, ensuring retirees can manage risk while maintaining a steady income stream.

- Tax Advantage: Unlike fixed deposits, only a part of each SWP withdrawal is taxable, significantly reducing the effective tax liability.

- Customizable Withdrawals: Withdrawals can be tailored to match inflationary pressures, ensuring retirees do not outlive their corpus.

Beating Inflation Through SWP

- Inflation Impact: Retirees can adjust their SWP amount annually to keep pace with rising living costs due to inflation.

- Long-Term Perspective: Over time, the SWP ensures that the corpus can grow and recover from market crashes, protecting against inflation’s effects.

- Periodic Adjustments: Retirees, withdrawing ₹75,000 monthly, can increase withdrawals as inflation pushes up living costs.

- Portfolio Resilience: Equity investments in the SWP help combat inflation as market recovery over time leads to portfolio appreciation.

- Real-life Example: Historical market crashes, like the 2008 financial crisis, show that long-term investors typically see their portfolios recover and grow.

Managing Risk with SWP

- Bucketing Strategy: Dividing the retirement corpus into different buckets (debt, hybrid, and equity) allows retirees to manage risk effectively.

- Withdrawal Hierarchy: Financial planners recommend withdrawing from the debt bucket first, protecting equity from short-term volatility.

- Market Volatility Protection: By keeping short-term withdrawals in debt funds, retirees are shielded from the immediate effects of equity market

- Equity Growth: The equity portion is allowed to compound over time, delivering long-term growth to support retirement needs.

- Hybrid Funds: Using hybrid funds with a lower equity component ensures that market downturns have a minimal impact on the early withdrawal phase

Risks Associated with SWP:

- Market Volatility: SWP returns are linked to market performance; a downturn could reduce the fund’s value, depleting the retirement corpus faster than expected.

- Corpus Depletion: Withdrawing more than the fund’s growth rate can lead to quicker depletion of the principal, jeopardizing long-term financial security.

- Inflation Risk: If the SWP withdrawal rate isn’t adjusted for inflation, the retiree’s purchasing power may erode, making it harder to meet future expenses.

- Taxation on Gains: While SWPs offer tax efficiency, changes in tax laws or incorrect fund selection may increase tax liability, reducing overall returns.

- Fund Selection Risk: Choosing the wrong mutual fund with poor or inconsistent performance can adversely impact returns, resulting in lower-than-expected income from the SWP.

Way forward / Planning SWP in Advance:

- Pre-Retirement Planning: Retirees should start planning their SWP strategy 2-3 years before retirement to avoid market shocks and optimize their portfolios.

- Tax Optimization: Early planning allows retirees to benefit from favourable long-term capital gains tax rates, enhancing post-retirement income.

- Avoiding Rushed Decisions: Proper planning prevents retirees from making hasty decisions, ensuring a smooth transition into post-retirement financial management.

- Sustainability Focus: Ensuring inflation-adjusted withdrawals sustains the retiree’s lifestyle over decades, crucial for financial security.

- Tailored Withdrawals: A well-constructed SWP strategy ensures the retirement corpus lasts as long as needed, without compromising the retiree’s quality of life.

Conclusion:

SWPs provide retirees with a tailored approach to generating steady income while managing risks and inflation. Strategic planning, fund selection, and periodic adjustments are crucial for long-term financial sustainability during retirement.

Source:Mint

Mains Practice Question:

Discuss the role of Systematic Withdrawal Plans (SWP) in retirement planning. How can SWPs help retirees manage inflation and market risks effectively?