How Inflation will Impact India’s Growth in 2023?

Context: Data showed that retail inflation grew by 5.7% in December, this is the fourth successive month when retail inflation has moderated.

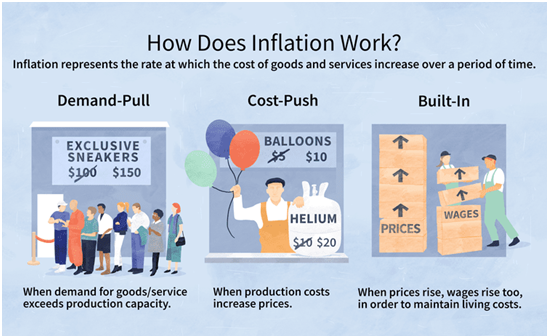

What is Inflation?

- Inflation is the rate of increase in prices over a given period of time. Inflation is typically a broad measure, such as the overall increase in prices or the increase in the cost of living in a country.

- It represents how much more expensive the relevant set of goods and/or services has become over a certain period, most commonly a year.

Headline and Core Inflation

- Headline inflation refers to the change in value of all goods in the basket.

- Core consumer inflation excludes prices that are more volatile such as food and energy.

- These are most affected by seasonal factors or temporary supply conditions.

How inflation in India measured?

- The Consumer Price Index and Wholesale price index are the main price indices in India.

- The WPI calculates prices received by producers of goods, while the CPI measures prices consumers face at the retail level.

- The wholesale pricing index (WPI) is the price of a typical basket of wholesale items.

- It considers a basket of 697 items and displays the total costs.

- The WPI was used by the Reserve Bank of India to make monetary policy until 2014

- The CPI measures price change at the retail level. It is based on 260 commodities, including some services.

- The Ministry of Statistics and Programme Implementation collects prices of sample goods and services on a regular basis (every month) and records any changes.

- Since 2014, CPI has been used by the RBI for monetary policy decisions.

Impact of High Inflation

- The elevated inflation levels robbed people of their purchasing power and worsened India’s trade deficit, which resulted in India’s currency becoming weaker and the RBI losing significant forex reserves as it tried to control the rupee’s downfall.

Prevailing Situation

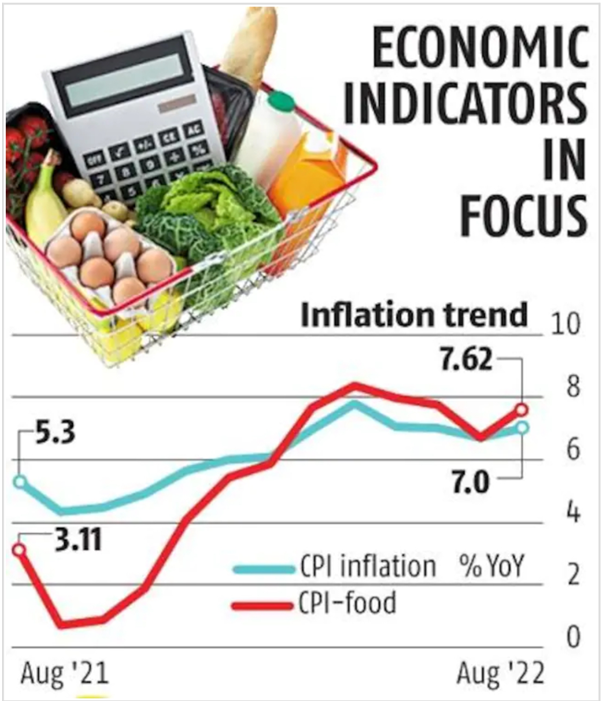

- The retail inflation in India remained above the mandated limit of 6% for ten months in 2022.

- Inflation trend has moderated all over the world and it is likely that the world has seen the worst of the inflationary spiral for now.

- To maintain the same situation central banks may still continue to raise interest rates.

- Generally higher interest rates bring down demand for money (both by consumers and producers) in the economy, and thus cool down inflation.

India growth and impact of Inflation

- In the last policy meeting, the RBI Governor had stated that core inflation is a concern. It has stayed at the 6% mark since September, and in December inched up to 6.1%.

- The core inflation picture proposes that while headline inflation may no longer be as big a worry as it was earlier, higher prices have seeped through in the broader economy.

- This means Indian consumers will have to pay higher prices even if fuel and food prices come down, other goods, everything from haircuts to rents will continue to be expensive.

- This will cut into people’s budgets and decrease down overall consumption.

- Data suggest that India’s GDP in the first six months of 2023-24 (April to September) grew by almost 10%, in the second half it is expected to grow by less than half that rate; just 4.5% to be precise.

- The domestic slowdown will likely be exacerbated by the likely global slowdown.

Thus, the situation is grim but on the positive side, the Indian economy is growing better than most of the developed countries. Inflation has also shown a decline, with enough policy measures India can smoothly sail 2023.

| Practice Question

1.Do you agree with the view that steady GDP growth and low inflation have left the Indian economy in good shape? Give reasons in support of your arguments. (UPSC CSE Mains 2019)

|