High Cost Of Financing: Why the Gold Bond Scheme Could End

Why in the news?

- Government Review: Sovereign Gold Bond (SGB) Scheme may be discontinued due to high fiscal financing costs.

- Policy Alignment: Budget 2024-25 reduced gold import duty, achieving the objective of boosting gold demand, initially addressed by SGBs.

- Market Adjustment: No SGB issuances have been made in the current financial year despite budget allocation reductions.

Sovereign Gold Bonds (SGBs)Sovereign Gold Bonds are government-backed securities issued by the Reserve Bank of India (RBI) on behalf of the Government of India. These bonds serve as an alternative to holding gold in physical form, offering financial and security advantages. |

Features and Advantages of SGBs

- Debt Instrument: Issued by RBI, each unit represents 1 gram of gold with a fixed interest of 2.5% per annum.

- Low Risk: Offers redemption in Indian rupees at market-linked gold prices, reducing storage risks.

- Investment Flexibility: Bonds trade in secondary markets, redeemable after five years with an eight-year tenor.

- Investor Benefits: Provides returns aligned with gold price appreciation and periodic interest payments.

Realizations and Concerns

- Fiscal Burden: High cost of financing fiscal deficit through SGBs outweighs benefits to investors.

- Shrinking Issuance: Reduction from 10 tranches annually to none in FY 2024-25.

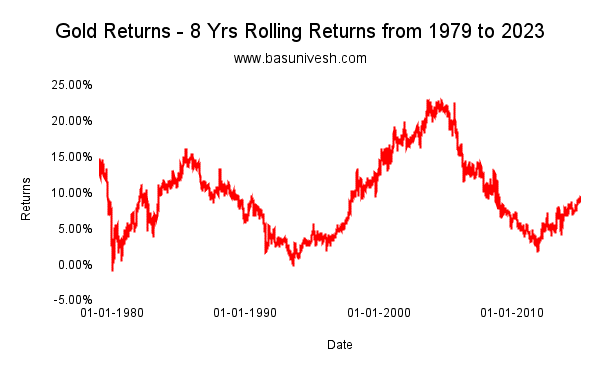

- Value Gains: Early SGBs delivered over 100% returns, yet demand shifts post gold duty cuts.

Future Outlook

- Policy Alternatives: Premature redemption window announced for bonds issued from 2017 to 2020.

- Sustainability Questions: As SGBs are not social schemes, their fiscal feasibility remains under scrutiny.

Sources Referred:

PIB, The Hindu, Indian Express, Hindustan Times