Gst reduced on cancer drugs,snacks,insurance review

Why in the news?

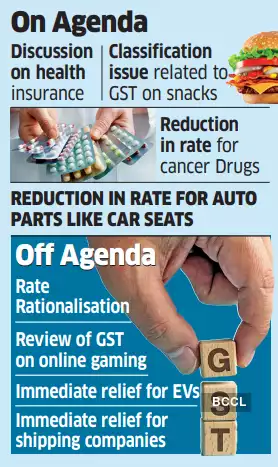

The GST Council slashed taxes on cancer drugs and snacks, and formed a GoM to review insurance GST rates, with decisions expected in November.

About the GST Reduction on Cancer Drugs and Snacks:

- The GST Council reduced the tax rate on cancer drugs from 12% to 5% during its 54th meeting in New Delhi, chaired by Union Finance Minister Nirmala Sitharaman.

- GST on selected snacks has also been reduced from 18% to 12%, aiming to make these products more affordable.

Group of Ministers to Review Health and Life Insurance GST:

- A Group of Ministers (GoM) will review GST rates on life and health insurance, with a report expected by the end of October.

- Decisions on rate reductions will be taken in November’s meeting based on the GoM’s recommendations.

About Goods and Services Tax (GST) Council :

- Established under the Constitutional (122nd Amendment) Bill, passed in 2016.

- The GST Council is a constitutional body that provides recommendations to Union and State governments on GST-related matters.

- Objective: Harmonise tax laws across states, eliminate cascading taxes, simplify tax structure, and reduce compliance costs.

Composition of GST Council:

- Chairperson: Union Finance Minister.

- Members: Union Minister of State for Finance and Finance Ministers from all states.

- Vice-Chairperson: Elected from among the Council members.

Functions of GST Council:

- Recommends taxes, cesses, and surcharges to be subsumed under GST.

- Determines goods and services to be subjected to or exempted from GST.

- Proposes GST rates, thresholds, and special provisions for natural calamities or specific states.

- Establishes mechanisms to adjudicate disputes between the Government of India and states.

Constitutional Provisions:

- Article 279A(1): GST Council to be constituted within 60 days of Article 279A commencement.

- Article 279A(4): Defines the Council’s authority to make recommendations.

- Article 279A(9): Decisions require a three-fourths majority, with one-third weightage for the Central Government.