“GOVERNMENT LOWERS CAPITAL GAINS TAX ON REAL ESTATE”

Why in the news?

The government lowered long-term capital gains tax on real estate from 20% to 12.5%, facing backlash, and allowed taxpayers to choose the more favourable rate for properties acquired before July 23, 2023.

About Tax Reduction and Options:

- Finance Minister Nirmala Sitharaman announced the long-term capital gains tax reduction from 20% with indexation benefits to 12.5% without indexation.

- An amendment to the Finance Bill, 2024, will allow taxpayers to choose between the two tax rates.

Relief for Property Transactions:

- The relief applies to the transfer of immovable assets, such as land and buildings, acquired before July 23, 2023.

- Taxpayers can select the rate that works out lower for their specific case.

source:scribd

About Capital Gain Tax:

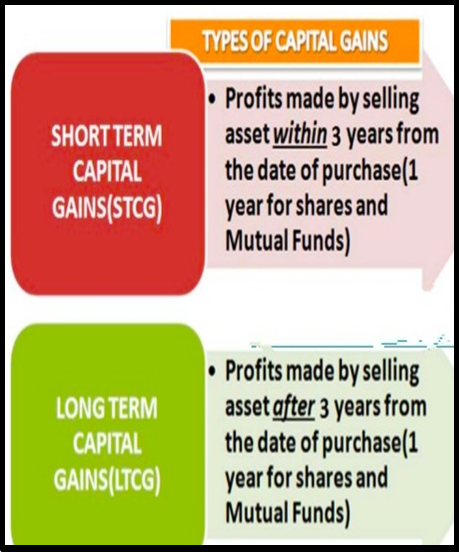

Types:

Associated Article: https://universalinstitutions.com/the-social-benefits-of-stock-market-speculation/ |