GOVERNMENT CRITICIZES CREDIT RATING AGENCIES

Why in the News?

- Finance Ministry releases “Re-examining Narratives,” addressing concerns with credit rating agencies’ opaque methodologies.

- Chief Economic Advisor V Anantha Nageswaran aims to present alternative perspectives on economic policy.

Source: Wall street Mojo

Role of Sovereign Ratings :

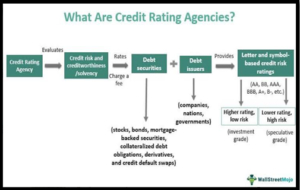

- Sovereign ratings indicate a government’s creditworthiness, influencing global investor perceptions.

- Analogous to an individual’s credit rating, lower sovereign ratings result in higher interest rates for government borrowing, impacting the entire country, including businesses.

Criticisms :

- Issues with rating agencies include opacity, potential discrimination against developing economies, and subjective assessments.

- Criticisms include non-transparent selection of experts, unclear weight assignments for rating parameters, and reliance on subjective qualitative overlays.

Government challenges the influence of composite governance indicators and calls for reduced dependence on subjective appraisals in credit ratings.

Source: Wall street Mojo

Source: Wall street Mojo